| Trade On This Platform | Trading Platform | About The Broker | About The Platform |

|---|---|---|---|

Trade On MT4 At XM XM | MetaTrader 4 Trading Platform | XM offers MetaTrader 4 on a range of account types including its Ultra Low Micro account (with very low trade sizes) and its Ultra Low Standard account, both with a minimum deposit of $5 About The Broker | MetaTrader 4 (MT4) is the cornerstone of Forex trading, offering automated trading, the ability to download robots and indicators and to program robots in the MQL4 language About The Platform |

Trade On MT5 At AvaTrade AvaTrade | MetaTrader 5 Trading Platform | AvaTrade offers MT5 with 1000+ markets to trade allowing EA online trading robots, with a $100 minimum deposit to use this platform About The Broker | MetaTrader 5 (MT5) deserves its position because it is the successor to MT4, just not so popular yet, offering a number of enhancements including a different language for robots and indicators, MQL5 About The Platform |

Trade On The easyMarkets Platform easyMarkets | easyMarkets Platform Trading Platform | easyMarkets offers Forex trading on the easyMarkets Platform, MT4, MT5, and TradingView, with fixed spreads on all platforms except MT5 About The Broker | The easyMarkets Platform is a user-friendly platform with fixed Forex spreads and providing tools such as Deal Cancellation and Freeze Rate (T&Cs apply) About The Platform |

Trade On TradingView At Pepperstone Pepperstone | TradingView Trading Platform | Pepperstone offers TradingView (through cTrader), also allowing automated trading on the platform with Pine Script and social trading About The Broker | TradingView is a third party platform offered through brokers which is known for its charting, but can also support automated trading and social trading About The Platform |

Trade On JForex At Dukascopy Dukascopy | JForex Trading Platform | Dukascopy Bank offers JForex through its SWFX ECN, with no restrictions on trading styles and offering accounts denominated in Gold About The Broker | JForex is a platform with a relatively large number of technical indicators built into the platform and provides automated Forex trading About The Platform |

Trade On cTrader At IC Markets IC Markets | cTrader Trading Platform | IC Markets offers cTrader, with high-speed order processing and supporting a wide range of trading from automated to news trading About The Broker | cTrader is a relatively user friendly platform, with a range of features for Forex traders, including automated trading About The Platform |

Trade On ProTrader At Vantage Vantage Markets | ProTrader Trading Platform | ProTrader is a user friendly Forex trading platform offered by Vantage Markets About The Broker | ProTrader provides a range of tools including an Economic Calendar and is powered by TradingView About The Platform |

Trade On ThinkTrader At ThinkMarkets ThinkMarkets | ThinkTrader Trading Platform | ThinkMarkets offers ThinkTrader, from a Standard account which does not have a minimum deposit requirement About The Broker | ThinkTrader is a platform which supports Forex trading styles which do not rely on robots, and provides a user friendly interface for the human trader About The Platform |

Trade On Deriv X At Deriv Deriv | Deriv X Trading Platform | Deriv offers leveraged Forex trading on its Deriv X platform (and MT5), with a minimum account deposit of $5 About The Broker | Deriv X is a user-friendly platform for traders who plan and execute their trades, and offers such features for Forex traders as an automated Trading Journal About The Platform |

Trade On The Plus500 CFD Platform Plus500 | Plus500 CFD Platform Trading Platform | Plus500 provides its platform from a watch app to desktop and aims to provide as a clear an interface as possible for those who plan and execute their own trades About The Broker | The Plus500 CFD Platform is a particularly user-friendly platform, aiming to provide an intuitive trading experience, including fundamental data integrated into the platform, helpful for those who keep an eye out for news About The Platform |

Top 10 Forex Trading Platforms

While the trader trades Forex through a broker (or more properly a CFD provider), they will do so on the trading platforms provided by the broker. This page has a list of 10 Forex trading platforms, which offer different kinds of features for the trader.

Forex trading is speculating on the change of value of Forex pairs, that is pairs of currencies valued against each other. For example, EUR/USD is Euro against Dollar. As these are relative valuations, the value of these pairs can change, resulting in volatile movements on a chart. Each currency is influenced by economic factors in the country it is tied to. Thus changes in US interest rates (the Fed Funds rate) could potentially result in the Dollar relatively moving upwards, against the Euro, if EU interest rates are not moving up as quickly. The economic conditions of the country ground each side of the currency pair, providing a basis for fundamental analysis, which is important in Forex.

However the complexity of relative valuations and the amplifying effect of leverage can result in a lack of clarity in Forex fundamental analysis. Thus many use technical analysis, which looks directly at the woods (instead of the trees), as it were, and tries to gauge clues for the direction a pair might move in. So a Forex trading platform needs to have both technical and fundamental analysis tools. However, platforms generally do as they are a staple of trading.

The trader may find that technical analysis is also unreliable, as it essentially uses past patterns in the market to predict a future direction or potential for direction. The market is prone to many influences, such as news and data, which can alter movement in unpredictable ways.

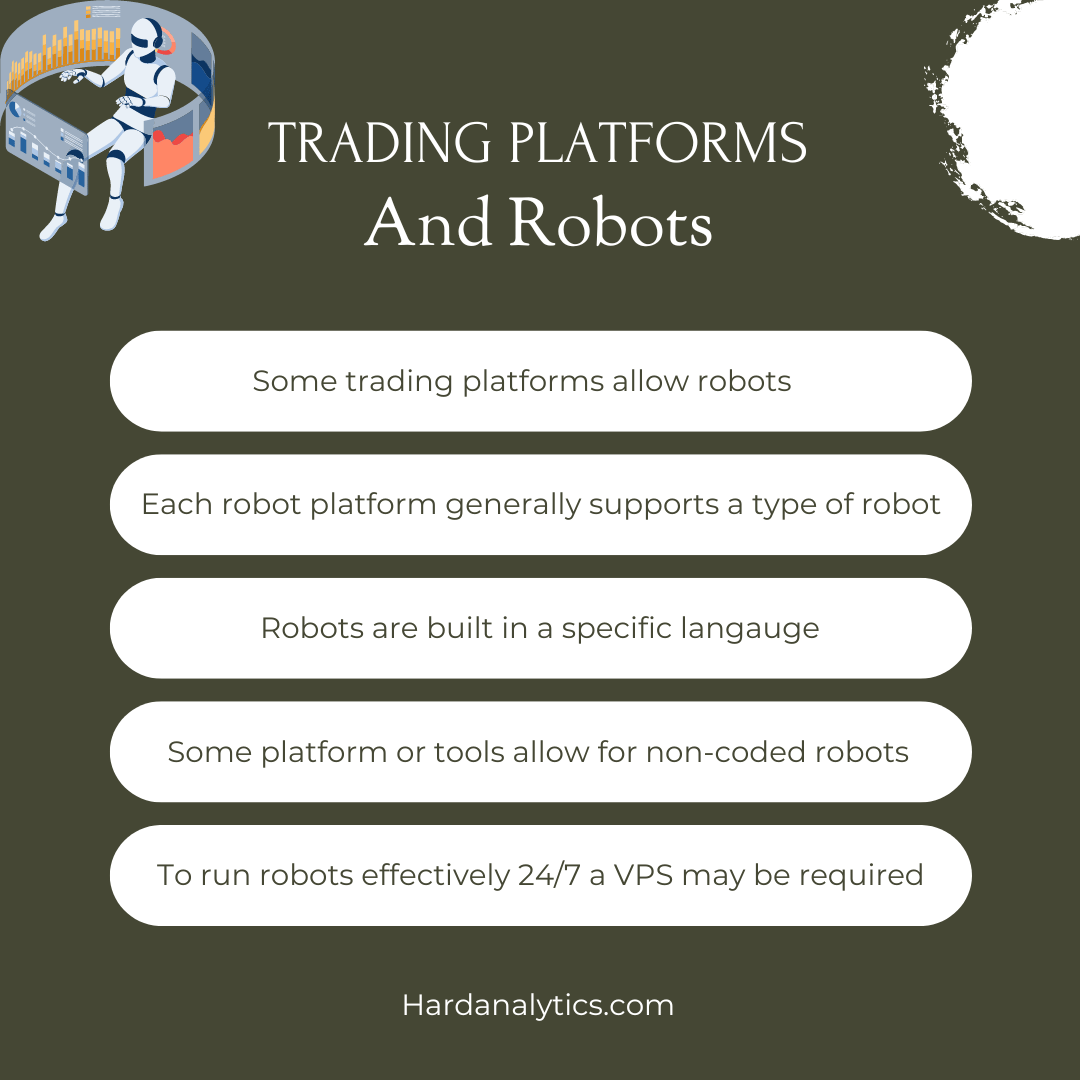

While it is open, the Forex market operates continuously (i.e. from late Sunday to Friday GMT). This means it can be difficult for the trader to track potential market action, by whatever analytical method they follow. To try and solve these problems, traders automate their trading and use robots. Robots are computer programs that are integrated into some trading platforms. Robots can trade around the clock without getting tired. So the trader can either use one already programmed (by downloading it, usually for a fee) or write their program, which is an algorithm that chooses when to enter and exit the market (and how to manage the trade). Robots however can result in losses, sometimes very rapidly in the trader's account.

Some traders may wish to use the knowledge of other traders, and copy their trades, and copy trading is a big part of markets, including Forex trading. However the platforms on the table seek to capture Forex trading itself, that is the trading which copies traders may follow, so it looks for platforms that seek to capture the core parts of Forex trading, either in their entirety or one or more types of trading.

The reality is the two main types of Forex trading, robot trading, and non-robot trading are very different in practice (while conceptually related) and the non-robot trading may have fundamentally different requirements. Platforms supporting robot (automated) trading tend to be focused on features for this kind of trading, while those for humans, aim to provide a clear interface for the human trader. This dichotomy is reflected in the choice of platforms above. Providers who aim to cater to both types of trading may offer different types of platforms, however, some platforms do provide for both types of trading.

It may be the case, that a trader starts with a user-friendly, human-centric platform and moves to a platform supporting robots, but it may also be the case that this does not happen, and it is possible to trade Forex without using robots ever. However the trader may find that the demands of the type of trading they wish to pursue may require a more automated approach and thus they may find that such a platform is necessary to at least try.

All platforms can be tried out on a demo at first, including platforms with online trading robots. A demo account provides virtual money (not real money) which can be used to test out the platform, ideas, and robots. A demo account is a good place to start and can provide a sense of what type of platform and tools the trader is ready for.