- Select broker features to narrow down a list of brokers, find out more about these features, create comparison tables, compare the brokers, answer questions, browse brokers and find a broker to trade with, based on the trader's preferences.

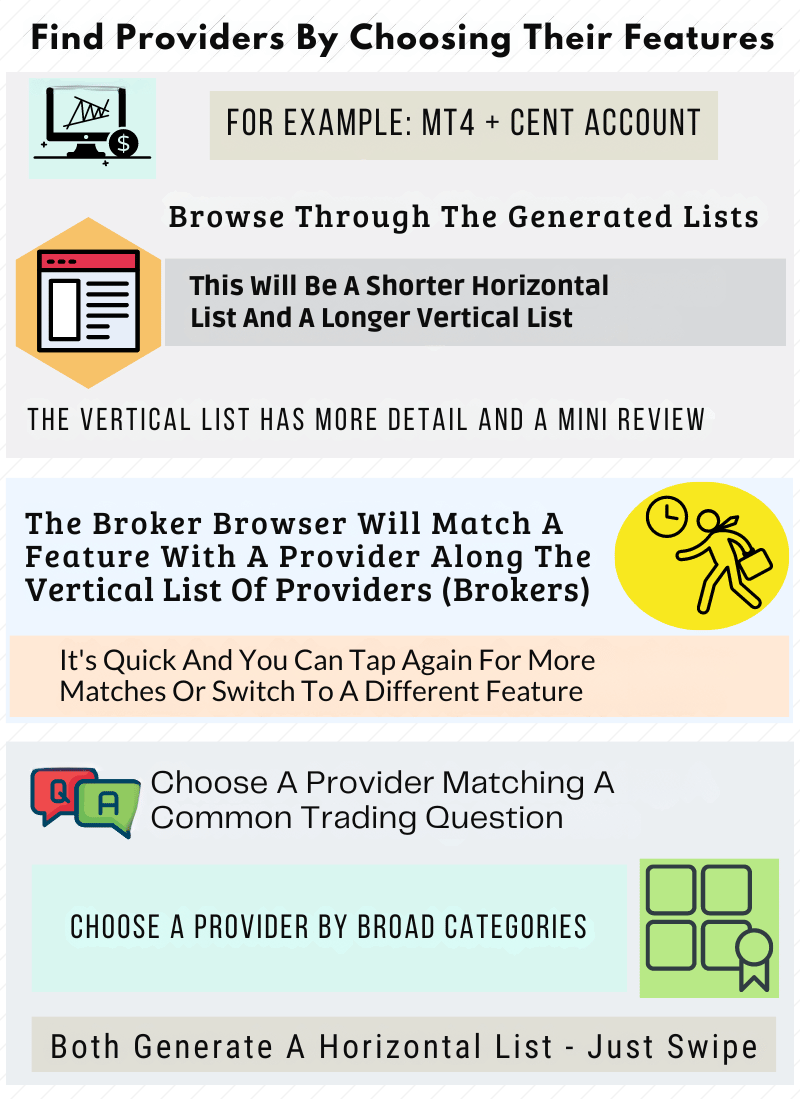

- Match brokers to categories (Explore), match brokers to questions (Ask), match brokers to features (Refine) or match a broker to a feature and browse (Broker Browser) and read a mini review focusing on key features.

- Idea - How to find a broker Demo: Select User Friendly Demo from Find Brokers . Find out more about a pair of brokers (and try more pairs). Compare them in the comparison table created for the trader. Sign up and try the broker.

- Hint Selecting the More About buttons will display more information about each broker in the message box . There is a summary box with key information as well. There is also an Info Hub with more information and ideas below.

- Idea - How to find a broker Questions: Select From Questions ? about brokers and trading. Click on the question. Find information about the topic and a pair of brokers with the desired features. Sign up and try the broker.

- Hint Selecting the Ask button will generate more questions.

- Idea - How to find a broker - Quickly More Experienced: Select a category from the Broker Browser. This will take the trader to a broker information box (a mini review) with this feature. Sign up and try the broker. Select More to generate more categories.

- Idea - How to find a broker More Experienced: Narrow down the list by selecting features. Create a comparison table with one click and compare the brokers. Find out More About each broker. Sign up and try the broker.

- Hint Choose selections from the Twin Tracks or from the Broker Browser. The Broker Browser is on the right of the screen. The Broker Browser is at the bottom of the screen. The results are shown as both a simplified horizontal feed (first) and a detailed vertical feed (below this). More About will go to the detailed feed for the chosen broker. To show the broker feed in a comparison table, select under 'Create a comparison table of the broker feed below', under the Matches count display.

- For example, selecting 'MT4 Brokers' will show a list of brokers with the MetaTrader 4 platform. Then selecting 'Cent Account' will show a list of brokers with MT4 and Cent Accounts, and so on. The tool will provide information about MT4 and Cent accounts during this process (and before if desired), pointing towards the kinds of trading supported by these features.

- Hint Selected features are shown by Select Features . If there are no matches and to restart, reset by selecting Reset. If there are no matches a broker will be suggested.

- Brokers in the horizontal feed have a Broker Score associated with them. This is a qualitative indicative score out of 10 based on features offered like platforms and markets to trade, but also includes factors such as how long established the broker is. For example, a broker which has a wide range of platforms and markets and has been around for a relatively long time, may do well, as might a broker which focuses on a type of trading.

- A brief description of each feature - identified by near the top of the page - is provided for matching the generated brokers with the type of trading which may be supported and exploring possibilities, as the selections are being made. Additionally the headline for each broker offers a snapshot of particular ways to trade supported by the broker.

- Hint Watch the message box for information about selections.

- The message box also provides information for Find Brokers Now which generates a comparison table for two brokers matching different types of trading as well as information about the brokers, including payment methods. This is potentially a quicker way to compare and find brokers to trade with.

- The selected broker detailed feed generated by the Twin Tracks or from the Broker Browser can be shown as a list or grid with abbreviated or expanded features, however it may also be displayed in a table. The table shows key features and will display one or more brokers, depending on what is in the list of brokers. So the tool can be used to firstly select brokers by features and then to compare the selected brokers.

- Hint Toggle between a short and a longer broker description with the Less Info More Info button on the Broker Browser. on the Broker Browser scrolls back to the top.

- Choosing on the Broker Browser brings up a grid of the selected brokers for online trading platforms and features comparison.

- Choosing brings back a list to browse.

- Brokers, features, and platforms may not be available in some regions and are subject to change. See each broker's website for availability and full terms and conditions. This content is for educational purposes and is not investment advice.

- Beginner or practicing trading

- Testing out trading ideas

- Trading with low spreads

- Using robots to execute trades

Some brokers offer a wide range of platforms, allowing different types of trading, from automated to trading based on analysis.

AvaTrade offers both MT4 and its successor MT5, providing a wide range of markets to trade. AvaTrade also provides a user-friendly, visually appealing Web Trader for traders who plan and execute their own trades, as well as FX Options trading on a separate, dedicated platform. EA online trading robots are available on MT4 and MT5.

Social and copy trading is supported via AvaSocial, DupliTrade, and ZuluTrade. On its AvaTradeGO mobile app and on its user-friendly Web Trader, AvaTrade offers AvaProtect which reimburses for losing trades: T&Cs apply, as well as Trading Central.

News trading is a strategy used by traders who want to trade around news releases, typically economic or other data which may affect a market, to be released at a pre-specified time and applying approaches based on conjectures about how the market might react from very short to longer time frames. In volatile market conditions, such as news trading, spreads can widen.

Pepperstone allows news trading, provides MT4, MT5, cTrader, and TradingView, and offers Forex spreads from 0 plus a commission charge. cTrader is a platform with advanced automated trading features in an arguably relatively intuitive layout. Pepperstone allows scalping on all its account types. While all platforms offer a web trading version, TradingView is designed as a user-friendly Web Trader.

The trader may use and build online trading robots in C# using cTrader Automate, and use and build EA robots on MT4 (in MQL4) and MT5 (in MQL5) and additionally automate trading on TradingView via Pine Script. Traders who have their own trading systems can access the API. Pepperstone can offer Forex spreads from 0 plus a commission charge on its Razor account.

Social and copy trading is supported at Pepperstone via platforms available depending on location. Autochartist, which scans for potentially significant market activity, is built into Pepperstone's MetaTrader platforms. The trader may start with a demo account initially.

Some providers offer a wide range of types of markets to trade on accessible user friendly platforms designed for the trader who makes their own trading decisions.

Plus500 provides a wide range of Commodities to trade including Wheat CFDs, Low Sulpher Gasoil CFDs, Palladium CFDs and Indices CFDs including NYSE FANG+, Sweden 30 and US-TECH 100. As well as supporting Commodities and Indices CFD trading, Plus500 has 2000+ CFDs to trade in total.

Plus500 offers a particularly clear, arguably intuitive Web Trader platform with charting tools including 115+ technical indicators, which lets the trader switch between live and demo accounts to practice trading, explore the platform and test out ideas. This platform is also available for desktop download for traders who want to trade from a web app.

Additionally, Plus500 provides fundamental data about markets from its platform which could be used when news trading, for example, what news might affect a market. The +Insights tool offers trends based on different categories to provide insights from the crowd of other Plus500 traders, including top 10 lists.

Plus500's platforms are provided from desktop to mobile and on a watch app. Plus500 offers an intuitive, user-friendly mobile app. The trader may start with a demo account to test out the platform and switch to it when they wish after creating a live account.

Some brokers allow a wide range of trading styles and offer infrastructure to support shorter frequency trading strategies as well as longer term.

IC Markets offers high-speed order execution, MT4, MT5, cTrader, and TradingView and supports styles such as news trading, scalping, and high-frequency trading as well as automated trading strategies (robots) and social and copy trading. EA robots are offered on MT4 and MT5, and cBots on cTrader. IC Markets offers 2250+ markets to trade. Traders who want a user-friendly Web Trader can find the TradingView platform.

IC Markets offers support for social and copy trading, with Myfxbook and ZuluTrade.

IC Markets can offer Forex spreads from 0 plus a commission charge and low spreads from 0.8 without a commission charge. The trader may apply for a live or a demo account. Web trading is available via MT4, MT5, and cTrader.

A low minimum deposit allows traders flexibility when making an initial deposit. Offering platforms such as MT5 and cTrader lets the trader explore their range of advanced trading features.

Deriv's wide platform offering includes MT5 and cTrader. Deriv EZ (on Deriv GO) offers CFD mobile trading on a user-friendly mobile app. On MT5, copy trading is supported via the Deriv Nakala mobile app and MQL5 Signals. Additionally, copy trading is available from cTrader. Robot traders can use EA robots on MT5 and cBots robots on cTrader. Deriv offers low spreads on Forex from 0.5 pips, without a commission charge.

Deriv provides the Deriv Academy to help advance the trader's education and improve their trading experience. Deriv supports advanced trading functionality via API access.

MT5 offers a range of CFD markets to trade, including Forex Pairs, Indices, Metals, Stocks, and Commodities. MT5 and cTrader are available as a web trader, desktop downloads, and for mobile. The trader may test out the platforms on a demo account. There is a $5 minimum deposit for a live account.

A low minimum trade size available on MetaTrader (aka a Cent account) means that the trader can potentially scale their trading from small position sizes to larger as their experience improves.

XM offers trading on MetaTrader 4 and MetaTrader 5 with Forex trade sizes from very small to larger, along with 1000+ markets to trade on MT5. On its Ultra Low Micro account (a cent account) XM allows trading down to 0.0001 standard lots, with a low minimum deposit of $5 (USD5) and low spreads from 0.6 pips without a commission charge. XM allows a wide range of trading styles, from robots to news trading to scalping. XM offers Forex spreads from 0 plus a commission charge on its XM Zero account. For mobile traders, XM provides its XM App, which is for both MT4 and MT5.

In common with some other brokers which support MetaTrader and EA robots, XM offers a VPS service. A VPS (Virtual Private Server) is a server that hosts EAs and operates 24/7, thus allowing the trader to run EAs when they want, without having to be connected to the broker.

For clients who meet certain conditions including a $5000 minimum balance and 5 round turn lots or 500 micro lots round turn per month, a free VPS is available (T&Cs apply), otherwise it is available for a $28 monthly fee.

XM offers a range of materials for traders, including the Global Markets Insights podcast, available across a wide range of podcast directories and available via RSS Feed. The trader may initially sign up for a demo account. Web trading is available via MT4 and MT5.

Traders may want to trade on fixed spreads rather then variable spreads, as this can mean the trader knows what the bid/ask spread is before making the trade.

easyMarkets is a fixed spreads broker. It offers fixed low spreads without a commission charge on its user-friendly, long-established Web Trader platform, MT4 (and allows all EA robots), and TradingView. Traders who want variable spreads can find them on MT5, from 0.5 (without a commission charge). easyMarkets says that it does not increase spreads during news trading events.

Slippage is when an order executes at a different price from the one given on the platform. EasyMarkets says that its easyMarkets platform has zero slippage. For a fee, easyMarkets provides dealCancellation, which lets the trader cancel a trade within a specified time frame, T&Cs apply. The trader may start with a demo account initially.

Some brokers offer MT4 along with other platforms, thus providing a wide range of ways to trade.

Dukascopy Bank offers MT4, MT5 and JForex, with 1000+ markets to trade on JForex.

Dukascopy Bank allows a wide range of trading styles including scalping and news trading. Automated trading is supported on MT4 (EA robots) and JForex. There is a Visual JForex tool that allows the trader to create trading strategies using drag and drop. The trader can also build automated strategies based on the JAVA programming language.

Accounts are available denominated in a wide range of currencies and are also offered in Gold, T&Cs apply. The trader may initially sign up for a demo account via the link below. Web trading is offered via MT4, MT5 and the JForex Web Trader.

Some brokers focus on providing a user-friendly trading experience as well as an accessible low minimum deposit.

IQ Option offers a range of markets to trade including FX Vanilla Options CFDs. IQ Option provides a user-friendly, distinctive Web Trader platform also available from mobile to desktop. IQ Option has a low minimum deposit of $10 and a trade size of $1. For Forex, the minimum trade size is 0.001 lots.

A low minimum deposit and order size means that the trader may trade on a live account with smaller trade sizes. However, the platform allows the trader to switch from live to demo, thus the trader can try out the platform on a demo account and then practice trading after creating a live account.

IQ Option provides a range of tools built into the platform, including News, an Economic Calendar, and an Earnings Calendar. An Economic Calendar provides information about upcoming data releases that may affect the market.

SabioTrade offers profit sharing funded accounts starting with a $10K account for the Basic package, requiring a fee, assessment and following the rules of the program. SabioTrade is classified as a trading education platform, not a broker.

SabioTrade offers a profit-sharing package that provides funded accounts to the trader, with a one-time fee. Following payment of the fee, the trader is assigned a SabioTrade Prop-Trading Assessment account. Traders have to pass this assessment to get a funded account, and there are rules that the funded trader has to follow to maintain the funded account. News trading is allowed as a strategy. Premium Education and Trading Signals are provided for all packages.

The one-time fee starts at $50 for the Basic package, increases to $289 for the Premium package, $479 for the Gold package, and $939 for the Platinum package. Each package provides increased funding, up to 200K for the Platinum package. The profit share starts at 70% for the Basic package and goes up to 90% for the Platinum package. Each package has the same Profit Target, Daily Loss Limit, and Max Trailing Drawdown.

The platform provided is the QuadCode platform, which is a user-friendly trading platform with a range of tools to assist the trader in both technical and fundamental analysis. The trader may try the program on a free trial, which does not offer a funded account, but can be a way to prepare for the initial assessment account.

Some brokers offer variable and fixed spreads accounts on MetaTrader.

The trader may trade the markets available at long established HYCM using the features of MetaTrader, such as automated trading and its range of charting tools. EA robots are available on MT4 and MT5. HYCM has a low minimum deposit of $20 for all its account types.

HYCM offers a range of account types, including a fixed spreads account, however, EAs are supported on its variable spread accounts. HYCM provides its HYCM Trader mobile app, which aims to provide a seamless mobile trading experience. Web trading is available with MT4 and MT5.

Some brokers offer a relatively wide range of account types, platforms, and features, thus allowing the trader to try different platforms, account types and ways to trade from one broker.

RoboMarkets provides a range of accounts from a Cent account to ECN trading accounts and offers the MT4, MT5, and R StocksTrader online trading platforms. RoboMarkets offers Forex spreads from 0 plus a commission charge.

On the R StocksTrader Web Trader, RoboMarkets has 12,000+ markets to trade. R StocksTrader is a platform that lets traders use and build robots and run them on the cloud, without needing a VPS. If the trader wants to use MT4 and MT5 robots (EA robots) they may do so as well. Additionally, RoboMarkets offers TradingView.

Additionally, this broker supports social and copy trading via CopyFX, which allows the transactions of selected traders to be copied and enables the trader's own strategies to be copied.

Some brokers aim to offer a wide range of platform and features, from low spreads to copy trading.

AAAFx provides MT4, MT5 and user friendly ActTrader, allowing automated trading. Additionally, copy trading is supported via ZuluTrade.

AAAFx has a low minimum deposit of $10, but also offers accounts with higher minimum deposits.

Forex spreads are available from 0 pips, plus commission.

In general brokers offering ECN Forex trading add a commission charge to the raw Forex spreads, by the way they route orders. However, it is possible to find such brokers that do not add a commission charge.

FXCC is an MT4 and MT5 broker offering its ECN XL account which does not have a commission charge but can provide tight ECN Forex spreads (T&Cs apply), with no minimum deposit. This account has restrictions on volume traded and has 30+ markets to trade (including Forex pairs). EA robots are offered on MT4 and MT5.

FXCC has a free VPS offer (via BeeksFX), T&Cs apply, for traders who maintain an equity of $2,500 and have a minimum trading volume of 30 lots round trip, each month. Web trading is available with MT4.

Robots are computer programs which execute trading strategies on behalf of the human trader and some brokers provide platforms and high-speed order execution to suit robot driven trading.

Vantage (formerly Vantage FX) offers trading on MT4 and MT5 and supports robot trading, using co-location with liquidity providers in Equinx's NY data center. Vantage offers Forex spreads from 0 plus a commission charge. EA robots are supported on MT4 and MT5.

For traders who want to run EAs when disconnected from the broker, Vantage offers a free VPS service (T&Cs apply) which has a minimum balance requirement of $1000.

Vantage additionally offers ProTrader, which is a user-friendly Web Trader platform and the TradingView platform.

Additionally, Vantage supports social and copy trading via its Copy Trading app, ZuluTrade, DupliTrade, and Myfxbook, and allows news trading. The trader may start with a demo account. Demo accounts for live account holders are unlimited (do not expire).

A Cent account lets the trader make very small trade sizes and potentially trade with smaller account sizes and can have a low minimum deposit.

RoboForex offers a Cent account and other MT4 and MT5 accounts with a low minimum deposit of $10 (USD10). On its Cent account (called Pro-Cent), trade sizes down to 0.0001 lots are available. Its ECN trading accounts, of potential interest in news trading, also have a $10 minimum deposit and include cTrader, a platform with robots. EA robots are available on MT4 and MT5, as well as robots on R StocksTrader.

RoboForex offers Forex spreads from 0 plus a commission charge. To use the R StocksTrader Web Trader, which has many markets to trade (12,000+), RoboForex requires a $100 minimum deposit. R StocksTrader provides a tool for building robots, which can be run on the cloud.

RoboForex supports social and copy trading via CopyFX. The trader may start with a demo account to begin with.

At some brokers, a wide range of trading styles can be accepted, though T&Cs may apply. Typically, these are brokers offering no dealing desk order execution.

FXOpen offers a trading environment with a range of markets including Forex Pairs and supporting styles such as scalping, which is short term trading made with increased frequency, as well as news trading. FXOpen offers Forex spreads from 0 plus a commission charge. EA robots are available on MT4 and MT5. TradingView supports automated trading via Pine Script. TickTrader is a Web Trader platform for those who execute their trades. Social and copy trading is supported via Myfxbook.

Scalping and High-Frequency Trading are welcomed on the STP and ECN accounts. The STP account has a minimum deposit of $10 while the ECN account has a minimum deposit of $100. The $1 low minimum deposit is for the Micro account, which offers trade size down to 0.0001 standard Forex lots (it is a Cent account).

Brokers which offer social and copy trading may do this by allowing a third party platform to connect with them.

ZuluTrade is one such platform but the trader may also sign up with ZuluTrade and add a broker. Copy trading has two perspectives, the trader copying other traders and the traders being copied.

ZuluTrade provides two types of accounts, an Investor account for those who want to follow trades and a Trader account for those who want their trades to be copied.

Brokers which support automated trading may have higher minimum deposits, however some can also offer a low minimum deposit account.

FXPRIMUS is an MT4, MT5 and cTrader broker offering trading in a 1000+ markets. FXPRIMUS has a low minimum deposit of $15 on its PrimusCLASSIC account, but a minimum deposit of $500 on its PrimusPRO account and $1000 on its PrimusZERO account. The PrimusPRO account has higher commission charges and a higher minimum spread than the PrimusZERO account.

Via the Copy feature on cTrader, copy trading is available at FXPRIMUS.

Some brokers do not use a dealing desk rather use routing algorithms within a trading infrastructure to support what is termed No Dealing Desk (NDD) trading. BlackBull has no minimum deposit for its ECN Standard Account.

BlackBull Markets is an MT4, MT5, cTrader, and TradingView broker. BlackBull Markets provides a trading infrastructure that supports a wide range of styles, particularly automated trading and styles requiring fast order processing. This broker says it does not use a dealing desk but rather relies on electronic algorithms to route orders to and from liquidity providers.

BlackBull additionally provides its Shares Trading Account, which has 26,000+ Shares CFDs to trade on its BlackBull Shares mobile app, along with other markets. Traders who use robots for automated trading can utilize EAs on MT5, cBots on cTrader, and Pine Script on TradingView. Traders who want a user-friendly Web Trader can find TradingView.

BlackBull Markets has a free VPS offer (via BeeksFX), T&Cs apply, for traders who open a BlackBull account, deposit at least $2000, and trade 20 lots per month across Forex or Metals. Social and copy trading is supported via BlackBull CopyTrader, ZuluTrade, and Myfxbook. Authochartist is available for free for those who want to access this pattern recognition analysis tool.

Some brokers aim to provide rapid order processing and support a wide range of trading styles, particularly robots. Some may also support social and copy trading, where the trader can copy other traders into their account.

Titan FX offers ECN trading conditions and the MT4 and MT5 trading platforms. Titan FX has its trading servers in Equinix's NY4 New York data center (the Financial eXchange), which is a hub for financial firms, utilizing co-location and proximity to provide low-latency data transmission to and from liquidity providers. While all online brokers use the ECN, ECN trading aims to provide a more direct route to and from liquidity providers and one approach is to locate the broker's ECN in a financial data center.

Titan FX has a free VPS offer (T&Cs apply) for traders who trade 5 lots and maintain a balance of at least $5000.

Titan FX provides a cent account (called its Micro Account), which has low minimum trade sizes down to 0.01 micro lots. This account has no minimum deposit.

Titan FX offers Forex spreads from 0 plus a commission charge. Web trading is available via MT4 and MT5.

Different trading platforms offer different functionality and support different ways to trade. Some providers focus on a user-friendly interface designed for the trader who plans and executes their trades. Plus500 describes its trading platform as a 'Leading CFD Platform'.

Plus500 offers a platform that is arguably intuitive to use, integrating different trading tools. Plus500 provides a relatively wide range of technical indicators (used for technical analysis) with 105+. Plus500's platform also supports fundamental analysis by providing information about news affecting particular markets, directly on the platform (to supplement the use of an Economic Calendar), as well as news and market insights.

From the platform, Plus500 offers +Insights. This provides real-time access to the activities of other Plus500 traders, selectable according to different categories such as Most Traded, Most Profit-Making Positions, and Most Loss-Making Positions, and referenced to individual CFD markets.

Plus500 offers a relatively wide range of CFD markets to trade, from Commodities (Hard, Soft, and Agricultural) to Indices to Forex and other markets.

The trader can sign up and test out the platform on a demo account, before depositing the minimum deposit of $100. The trader can then switch between live and demo accounts, to take a break and practice trading.

MetaTrader offers the trader the capacity to plan and execute their trades, as well as supporting the use of robots, which the trader can also build. MetaTrader 5 (MT5) is the successor platform to MetaTrader 4 (MT4) and has several enhancements including more platform tools.

XM provides 1000+ markets to trade on MT5 and also offers MT4. Traders can use either platform when they have signed up with XM.

XM allows a wide range of trading styles and supports EAs. EAs (Expert Advisors) are MetaTrader's online trading robots, which can be used or built by the trader to execute trades on their behalf.

XM has a very low minimum deposit of $5 and offers a cent account, which has very low minimum trade sizes.

No dealing desk brokers typically support a wide range of trading styles, from automated trading to scalping to news trading.

Pepperstone offers 1000+ markets to trade and provides MT4, MT5 and cTrader, with no dealing desk order execution. A wide range of trading styles is supported.

Traders can news trade, use and program EAs (MetaTrader's robots) and cBots (cBots are cTrader's robots). Traders can take advantage of high-speed order execution and tight low spreads when running their strategies. Spreads are offered from 0 plus a commission charge and 1 without a commission charge.

Offering MT5 and cTrader in one broker with a low minimum deposit can provide a range of accessible functionality to the trader.

Deriv offers the multi-asset platform MT5 (the successor to MT4), and cTrader (with a range of advanced features), as well as the Deriv EZ mobile platform.

The trader can test out all the platforms via a demo account and the minimum deposit for live trading is $5 (but there is no minimum deposit to fund the MT5 or cTrader CFD trading accounts from the main Deriv account). Copy trading is available on both MT5 (including on the Deriv Nakala mobile platform) and cTrader.

Some brokers offer MT4 and MT5 and can provide support for copy trading.

AvaTrade provides MT4, its successor MT5, a user-friendly Web Trader, and offers social and copy trading via the AvaSocial platform, ZuluTrade, and DupliTrade. Additionally AvaTrade offers Vanilla Options trading via AvaOptions.

On its Web Trader and its AvaTradeGO mobile app, AvaTrade provides AvaProtect which reimburses for losing trade: T&Cs apply.

Brokers may offer platforms which are aimed at traders who want to run algos.

Dukascopy Bank offers Forex trading and a range of other markets on JForex. JForex has tools for traders who make their own trading decisions (including a relatively wide range of inbuilt technical indicators) and those who use robots, based on Java. Dukascopy also provides MT4 and MT5 and allows EAs, MetaTrader's robots.

Dukascopy has a range of funding options and account currencies, and also offers account denominated in Gold (XAU), T&Cs apply.

Some brokers offer a wide range of platforms to trade Forex and other CFD markets.

Vantage provides MT4, MT5, ProTrader and TradingView. ProTrader is an intuitive, user-friendly platform with features such as in-depth curated news. Vantage can provide Forex spreads from 0, plus commission. Copy trading is supported by a range of third-party platforms and the Vantage App.

Vantage offers the popular TradingView platform, which, like MT4 and MT5, supports automated trading as well as self-directed trading.

Brokers may offer fixed spreads along with variable spreads, however, some brokers may focus on fixed spreads.

easyMarkets offers fixed spreads on its user-friendly platform, MT4 and TradingView (and has variable spreads from 0.5 on MT5).

easyMarkets offers dealCancellation, which lets the trader cancel a deal for a fee, T&Cs apply.