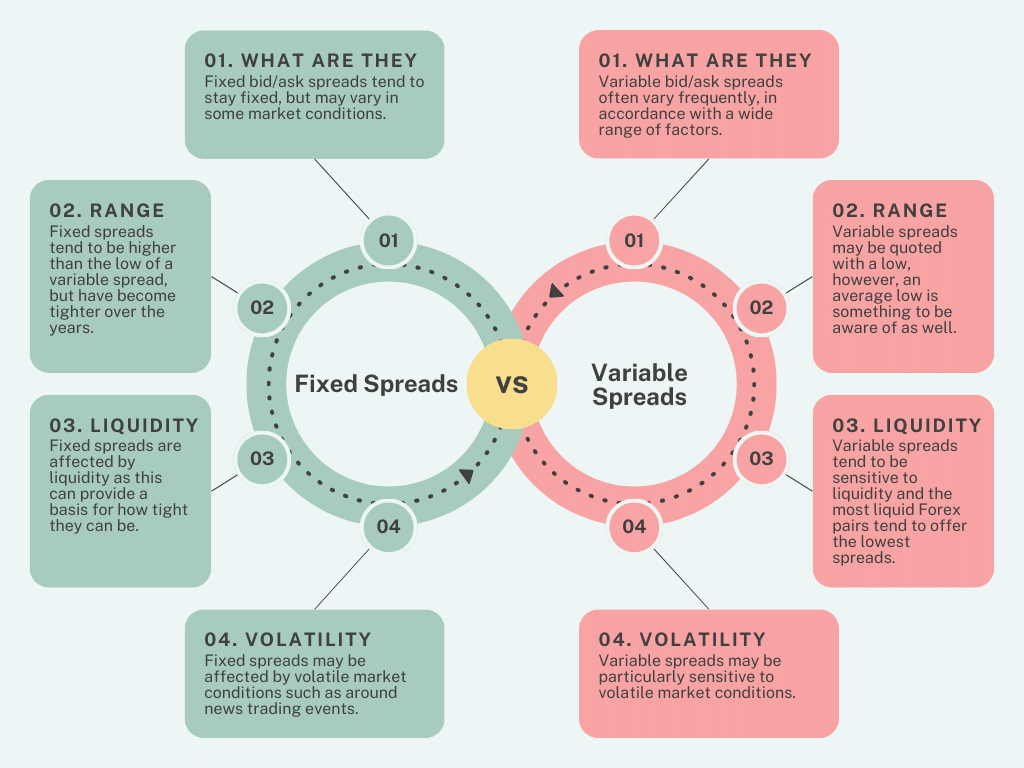

The spread is the difference between the bid and ask spread of a Forex pair. Spreads can be variable or fixed. Fixed spreads tend to stay the same, though might also change in some market conditions. Fixed spreads may tend to be higher than the quoted low for a variable spread, however, fixed spreads have tended to track lower over the years.

Brokers which allow automated trading will tend to offer variable spreads, perhaps with a low average spread, though it is possible to find brokers which offer fixed spreads with robots.

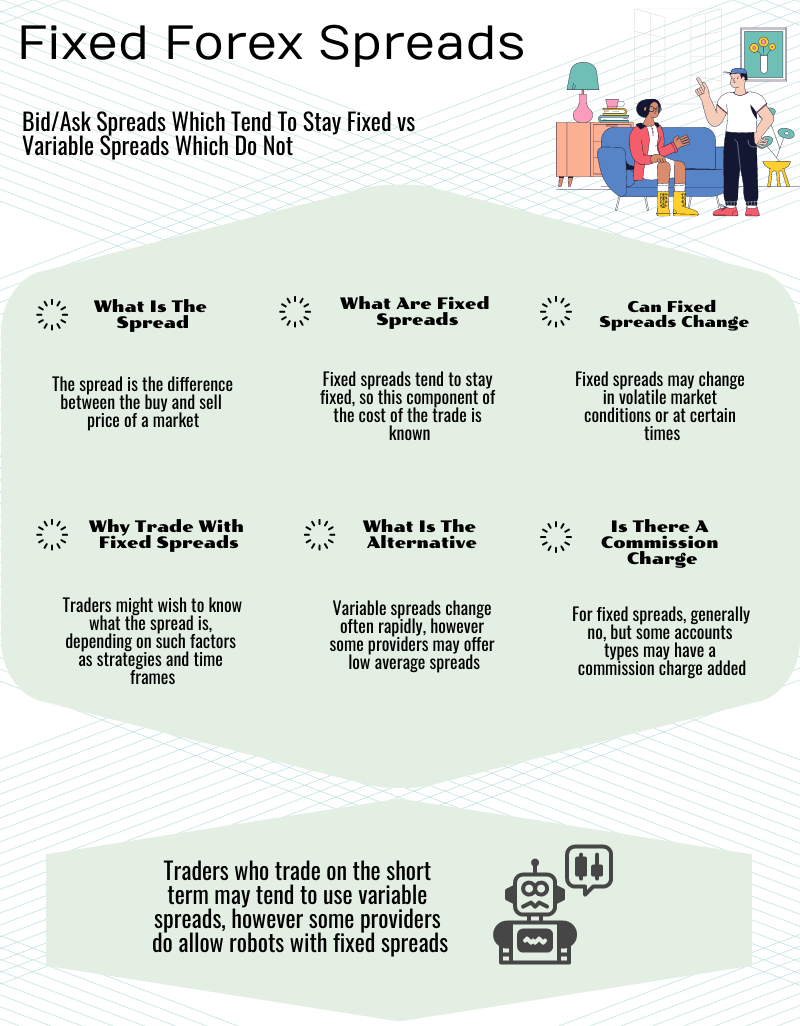

The page provides a selection of fixed spread brokers, with different features built around this spread type. There is also a longer article and an infographic about fixed spreads and how they relate to Forex trading as well as a fixed spreads vs variable spreads comparison infographic.

| Online Provider | About | Minimum Deposit | Fixed Spreads Platforms |

|---|---|---|---|

| Robots And Fixed SpreadseasyMarkets | easyMarkets is a long-standing fixed spreads Forex broker, offering fixed spreads on MT4 (from 0.7 pips), the user-friendly easyMarkets platform and TradingView About | $25 Minimum Deposit | MT4, easyMarkets Platforms, TradingView Fixed Spreads Platforms |

| MetaTrader Fixed SpreadsHYCM | HYCM offers a fixed Forex spreads account with spreads from 1.5 pips About | $20 Minimum Deposit | MT4, MT5 Fixed Spreads Platforms |

| MT4 Fixed SpreadsNSFX | NSFX offers a fixed spreads MT4 trading account, with a $300 minimum deposit for trading FX Major Pairs and fixed spreads from 3 pips About | $300 Minimum Deposit | MT4 Fixed Spreads Platform |

The spread is the difference between the bid and ask price of a market. This is an important part of the cost of a trade and thus traders may look for Forex spreads that are as low as possible. Some traders may prefer fixed spreads to variable spreads. This article looks at the significance of fixed spreads for Forex traders.

The value of a Forex pair will tend to have a difference between the price at which it is bought and the price at which it is sold. From this difference, providers receive compensation. This difference is called the spread, or in full the bid/ask spread. In some cases, the spread may be zero, however.

For shorter terms traders and automated traders the spread can be a significant factor. Thus providers who specialise in automated trading and scalping may offer low bid/ask spreads. In the case of both strategies, the trader may be making short-term trades, thus the spread cost might be relatively significant compared with the capacity of the value of the market to change within a short-term period. As variable spreads can range higher, then they may also look for low average spreads.

However other traders may be more interested in stability in the spread of a market, which can be found in spreads that are formatted to stay the same. These kinds of spreads are called fixed spreads and the trade-off tends to be the spread cost. That is, variable spreads may tend to range lower or have low average spreads, while fixed spreads may tend to be fixed at a higher value than the low or the average low (in some cases).

One factor to note about fixed spreads is that they do not necessarily stay fixed, and can vary in volatile market conditions or at certain times. Some providers do say that their spreads will not vary, however, it might be the case that a trade placed in volatile market conditions may not get filled (this can also happen with variable spreads).

Providers which offer platforms and accounts for automated traders may also in some cases offer fixed spreads, thus the trader in this case can trade robots with fixed spreads, if this kind of trading is supported with fixed spreads. Fixed spreads however may be more commonly associated with longer term trading and strategies (or at least not strategies such as scalping or automated trading). That is to say, strategies that are less dependent on volatility may seek more stable spreads.

Given that there has been a trend for fixed spreads to go downwards, like variable spreads, then different types of traders may be interested in fixed spreads Forex brokers, with the caveat that some strategies may not be possible, or may be better executed in different account types.

Automated traders and scalpers may wish to find a provider which specialises in robot trading or scalping, and which normally offer tight variable spreads, with a commission charge. The commission charge is a fixed component of the trade, but it is not a spread and is added to the trade by the provider (and is another way for the provider to receive compensation). There can also be other components to the cost of the trade, whether spreads are fixed or variable.

Robots And Fixed Spreads easyMarkets

- Minimum deposit: $25

- Online trading platforms: MT4, MT5, easyMarkets Platform, TradingView

easyMarkets offers fixed spreads (including Forex spreads) on MT4, the easyMarkets Platform and TradingView. The lowest fixed Forex spreads are on MT4, from 0.7. easyMarkets also offers variable spreads on MT5.

easyMarkets does not have a commission charge and allows automated trading and news trading. easyMarkets offers features such as dealCancellation which lets the trader cancel a trade within a specified time, for a fee. The Freeze Rate feature fixes the price of the market for a few seconds (while the spread is fixed, the value of the market is not).

MetaTrader Fixed Spreads HYCM

- Minimum deposit: $20

- Online trading platforms: MT4, MT5

HYCM is a very long established MetaTrader broker (since 1977) offering Forex trading now on MT4 and MT5 (as well as mobile trading). HYCM offers accounts with variable Forex spreads for those who trade with and without robots. However, it also provides a fixed Forex spreads account, which has spreads from 1.5 pips. This account does not allow EAs, so it is for those who want to trade using their own analysis and trade execution.

MT4 Fixed Spreads NSFX

- Minimum deposit: $300

- Online trading platforms: MT4, JForex

NSFX offers a trading account with fixed spreads on Forex Major Pairs, from 3 pips. This account has a minimum deposit of $300. The fixed spreads account does not allow scalping or EA robots. Traders who wish to scalp or use EAs can try the other accounts at NSFX, which have variable spreads and higher minimum deposits.