Swing trading typically involves taking positions longer than a day trade but shorter than a buy and hold, while allowing for active trading to counteract market complexity and volatility. That is, it can be seen in practice as a dynamic activity to manage positions over time. It aims to smooth over the volatility of day trading and the risks of buy and hold, including in leveraged markets, though it can also be applied to unleveraged markets as these can also display volatility over time as well as more complex movements such as ranges and volatile patterns.

Swing trading can express a belief in a market perhaps based on fundamentals but one which needs management, particularly with technical trading. Markets that are swing traded include Forex, and Forex brokers may thus offer features suited to this kind of trading, even though they may be used extensively by day traders. A selection of brokers potentially offering features for swing traders is provided below, as well as a longer article and three infographics about swing trading, including two trading style comparisons.

| Online Provider | About | Minimum Deposit | Forex Trading Platforms |

|---|---|---|---|

| Automated TradingPepperstone | Pepperstone provides tight spreads, and offer platforms such as cTrader and TradingView, with advanced charting. All of Pepperstone's platforms provide automated trading About | $200 Minimum Deposit | MT4, MT5, cTrader, TradingView Forex Trading Platforms |

| Self Directed TradingPlus500 | Plus500 offers an intuitive platform for those who plan and execute their trades. An Economic Calendar is built into the platform as well as comprehensive charting, on a particularly clear trading interface About | $100 Minimum Deposit | Plus500's CFD Platform Forex Trading Platforms |

| Innovative PlatformsDeriv | Deriv provides cTrader, which has a clear, user-friendly interface. Deriv also offers MT5, which offers a human-friendly trading interface for its web trader. These platforms also have advanced features, including automated trading, copy trading, and the capacity to download or make technical indicators and online trading robots About | $5 Minimum Deposit | MT5, cTrader Forex Trading Platforms |

| Fixed SpreadseasyMarkets | easyMarkets offers fixed spreads on MT4, the user friendly easyMarkets platform and TradingView. easyMarkets provides fixed spreads across a range of markets including Forex and Stocks CFDs About | $25 Minimum Deposit | MT4, MT5, easyMarkets Platform, TradingView Forex Trading Platforms |

Think about holding a position which is bought low according to some analytical metric and then waiting for it to go high. This is arguably the core of unleveraged stock trading, the idea that clues can be seen in the financial statements as to whether a stock is undervalued or not and the market may take it up at some stage if it appears to be. So positions can be held for as long as it takes. This itself can be seen as the strategy upon which all trading is based, with the opposite strategy of going short supported to different extents. However, each market can have different characteristics, suggesting modified or different approaches.

In leveraged Forex trading, position trading like this can be problematic as the market moves in complex ways up and down, even if it finds a direction, and fundamentals can also be more disparate in their effect. A direction apparent in one time frame may be composed of sharp retracements, which might be more evident in a lower time frame. But this core concept of trading can be adapted for this and other volatile, complex markets traded with leverage (leverage tends to amplify risk).

What is swing trading ?

Swing trading is a potentially more dynamic type of trading that can aim to be responsive to complex charting movements. Swing traders may day trade positions, but extend over time, perhaps days or weeks, moving in and out of trades and adjusting trade size. But positions are managed following the charting data and fundamental news indicating potential changes in direction, momentum, and volatility - i.e., swings. This is one reason why technical indicators are also important, as they can point to and provide a rationale for decisions about these market features affecting direction and patterns. Forex swing traders may wish to consider closing positions at the end of the week, as the weekend can bring sharp volatility from surprise news events.

Trends, ranges and swing trading

A trend may be a good focus for a swing trade, but trends can end, reverse, and turn into ranges. A trend will still need management, as it can evidence retracements as part of its overall direction, which can also offer opportunities to increase or decrease positions, as well as exit and entry points. Ranges can be a more challenging focus for a swing trade, needing more attentive management.

Volatility and swing trading

Intense volatility around news trades, for example, can be a reason to exit the market for the duration, as this kind of volatility may take out stop-losses and invalidate trades, at least temporarily. An Economic Calendar is a way to get a heads-up about news events and their potential effect on Forex pairs. A Calendar is typically offered on the broker website; however, increasingly, they are provided and integrated into trading platforms. This said, news inputs into the market can occur unexpectedly and may have a sharp effect on market values, which is a risk in all trading, but particularly across longer trading time frames.

Fundamental and technical swing trading

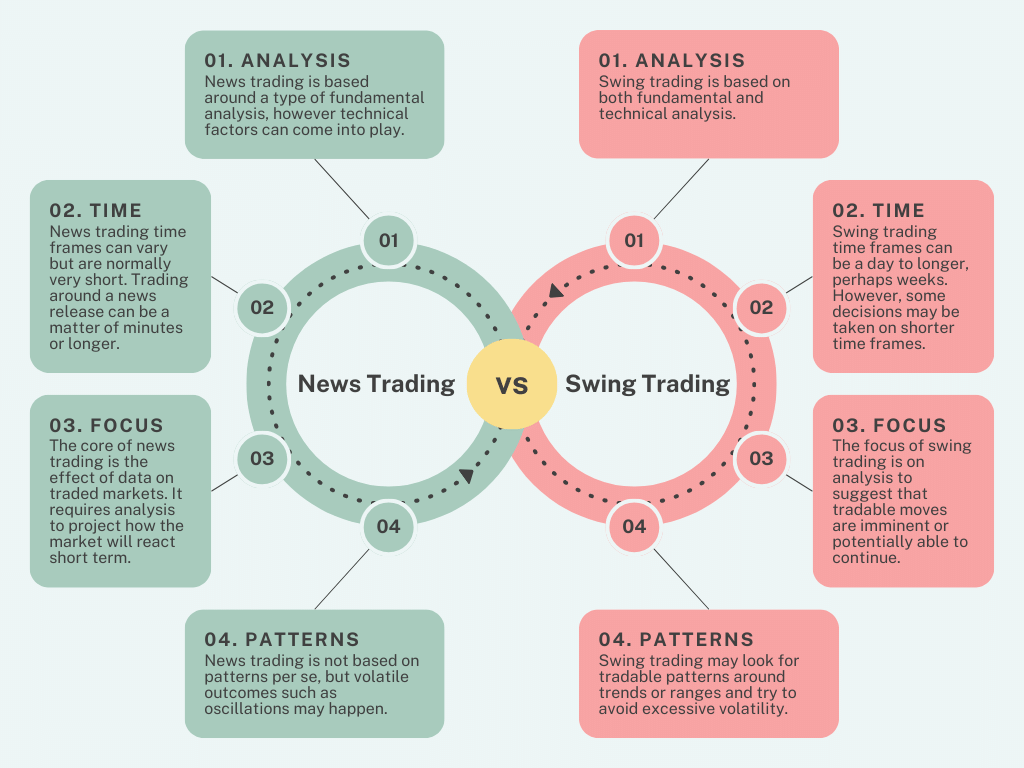

Swing trading can be both fundamental and technical, versus shorter-term trades which may be more particularly one or the other (e.g., news trading leaning sharply fundamental and scalping leaning sharply technical). The longer a position is traded, the more fundamentals may come into play as well as technical factors. A motivation for short-term trading can be to try and avoid these complications, but swing trading may be seen as aiming to embrace them or at least to use strategies to minimise them.

To give an example, a technical indicator such as MACD used by many traders might give signals of a trend incoming or a reverse perhaps, and these can be used to reduce, add to or even close entirely a position. However, fundamental data can also be used to provide either additional verification of this decision or to change the magnitude of such a decision. Fundamental data, including interest rate decisions, may provide a longer-term direction pull on a market, but within which it can range, trend, retrace and, in effect, produce complex behaviour.

Forex is a complex market

It has to be noted that the complexity of the Forex market is evident at all scales. Even on short-term news trades, unexpected outcomes may happen, as well as complex patterns. This is true as well in the longer term, as patterns can take different forms from an expected pattern outcome, for example. Thus, a swing trade on a trend might become a more complex trade on a range or into volatility.

Support and resistance

One factor that is important at all scales is support and resistance. These are horizontal layers on a chart where the market in question hit against a limiting move one or more times in the past, producing more complex, rather than directional behavior, up (resistance) or down (support). Support and resistance can play a role in swing trading, as they may point toward potential swing moves or a pause or even the end of them.

It might be said that even in short-term trading where the market is considered traded during a day trading session, the trader is still looking to hold for as long as they can, relative to the traded time frame. To some extent, all strategies may seem similar (one could speculatively view swing trading to some extent as a kind of long-term extended scalping trade, though there are clear differences as well).

How to choose a broker for swing trading

So what kind of broker would a swing trader want? It depends on what markets they may wish to swing trade and whether leveraged or unleveraged. This site focuses on leveraged trading, thus brokers offer markets such as Forex, Indices, Metals, or other leveraged markets which can have a directional bias over time, but also will display complex directional changes.

For swing trading, volatility is important in that the market needs to move directionally, but not too much volatility, as this can be a risk to the continuity of the trade. These are indicators that may point towards volatility in a market as well as the potential for trends (e.g., ADX), but swing traders may need to delve into fundamental data to see if there is this kind of sustained directional pull on a market in existence, to help sustain a swing trade. At the day trading level the market can be highly technical (absent news trading events) but over the medium term fundamental effects may be more evident.

Secondly, since this is usually chart-based trading, then a broker with good charting may be of interest. Good charting can mean clear charts with a sufficient level of detail in terms of such factors as time frames and chart price types. Charting is key as it provides a basis for viewing the market in the medium term. One way to get a view of what is happening now vs the longer term is multiple time frame analysis, which is a way of examining different time frames of the trader's choosing to gauge clusters of support/resistance, momentum, and potential direction.

Robots and swing trading

This said, traders may seek other platform features and may not be too concerned with charting presentation. For example, traders may want to let a robot swing trade on their behalf; thus, a provider offering automated trading features might be considered. Robots are used in short-term trading but they are also utilised in longer-term trading. Short-term trading has issues due to frequency, but longer-term trading can be quite complex, as well as it involves adjusting trades based on signals. This kind of activity can be performed by robots, however. This said, robots may tolerate levels of drawdown, which a human trader may not. There are also trading platforms focused on markets like Forex, which offer both detailed charting and robots, cTrader being a notable example.

Are spreads important ?

Short-term traders tend to be focused on spreads, but swing traders may be less concerned with spreads. However, spreads may still be important, as trades will be adjusted or opened and closed over time. Many Forex brokers offer tight spreads, especially for the more liquid traded Forex pairs. Brokers that tend to be used by automated traders and scalpers may offer very tight spreads, both from the low and the average, but there is typically also a commission charge added.

For swing traders, the commission charge may be less of a burden than for a frequent day trader. This said some swing traders may find a fixed spreads broker more suited to them as they will be able to calculate this part of the cost of a trade in advanced of extended trade (with the caveat that fixed spreads may widen in certain market conditions, or trades may not go through if they do not).

Swing trading and social trading

Swing traders may wish to see the views of other traders; thus, social trading might be important. Some platforms have social trading features (such as an integrated feed), but others do not. It depends on how important this kind of data and interaction is for the trader. It might be said that social trading is one way to try to deal with the complex maze presented by a Forex chart. If the trader wants another swing trader to trade on their behalf, they can copy the trade and let that trader make the trading decisions.

As well as charting tools such as technical indicators and graphical objects, swing traders may need to keep track of what they are doing and how the rationale of a trade may change over the medium term. One way to do this is to keep a trading journal and update it with the changing effects and possibilities presented by alterations in fundamentals and technical signals.

Therefore, this page includes a range of different types of providers with different types of features which may be of interest to swing traders. Is there an argument for having more than one provider? There might be, as it is a way to diversify risk as well as features. This said traders may well be happy with one provider offering a sufficient range of features for their swing trading needs. The brokers on this page are chosen for their longevity, reputation, platforms, and features, but as always, traders need to do their research and evaluate risks.

Try it on a demo

In all events, all of these providers may be tested on a demo account, either after a live account is created or before. Practising on a demo with a swing trade can be a way to get a more sustained perspective on the platform, rather than trying a few day trades and then starting on a live account. A swing trade can provide insights into the complexity of all markets and how volatility and momentum can alter movements, as well as factors such as support/resistance, fundamentals, and technical signals. More details about the suggested brokers in the table above are provided below.

Intuitive Platform Plus500

- Minimum deposit: $100

- Online trading platform: Plus500's CFD Platform

Plus500 is a long established CFD provider offering 2000+ markets to trade, including Forex, Stocks, Indices and Commodities CFDs. Plus500 offers its CFD trading platform, available for different platforms, from watches to desktops (with differences in features). Plus500's CFD platform offers particularly clear charting aimed at the trader planning and executing their trades. Arguably, swing trading may be suited to the type of trading Plus500 supports.

Automated Trading Tools Pepperstone

- Minimum deposit: $200

- Online trading platforms: MT4, MT5, cTrader, TradingView

Pepperstone began as a provider specialising in automated trading and scalping, but has expanded its offering and types of platforms over the years. Swing traders can find platforms such as cTrader, TradingView, and MT5. Pepperstone's commitment to tight spreads remains, and the trader can find Forex spreads from 0 pips plus a commission charge, as well as spreads without a commission charge. In the UK tighter spreads may be found on its spread betting platform.

Deriv cTrader Deriv

- Minimum deposit: $5

- Online trading platforms: MT5, cTrader

Deriv provides leveraged CFD trading on MT5 and cTrader. Both of these platforms can be used by swing traders. However, cTrader has a clear interface with charting that the trader can use to plan their positions. Additionally, Deriv provides social and copy trading via MetaTrader Signals (MT5), the Deriv Nakala mobile app, and the 'Copy' feature on cTrader.

Fixed Forex Spreads easyMarkets

- Minimum deposit: $25

- Online trading platforms: MT4, MT5, easyMarkets Platform, TradingView

easyMarkets provides fixed Forex spreads on MT4, the easyMarkets platform, and TradingView, while offering tight variable spreads on MT5. The easyMarkets platform has a user-friendly interface that may be used by swing traders, although easyMarkets' other platforms also offer features applicable to this type of trading, particularly TradingView.