| Online Provider | About | Minimum Deposit | Forex Trading Platforms |

|---|---|---|---|

| Automated Trading ProviderDukascopy | Dukascopy Bank offers both MT4 and JForex (with a demo for each). Dukascopy provides a wide range of CFD markets and offers access to its SWFX ECN, with low Forex spreads plus a commission charge About | $1000 Minimum Deposit | MT4, JForex Forex Trading Platforms |

| Wide Range Of FeaturesAvaTrade | AvaTrade offers a demo account which lets the trader test out its platforms, MT4, MT5, its user friendly WebTrader and its mobile app, AvaTradeGO. AvaTrade can offer over 1000 CFD markets to trade About | $100 Minimum Deposit | MT4, MT5, Web Trader, AvaTradeGO Forex Trading Platforms |

| Small Trade SizesXM | XM offers a demo account with a $100,000 virtual balance (not real). For those moving to a live account, XM has a small minimum deposit of $5 and can provide an account (its Micro account) with very small trade sizes About | $5 Minimum Deposit | MT4, MT5 Forex Trading Platforms |

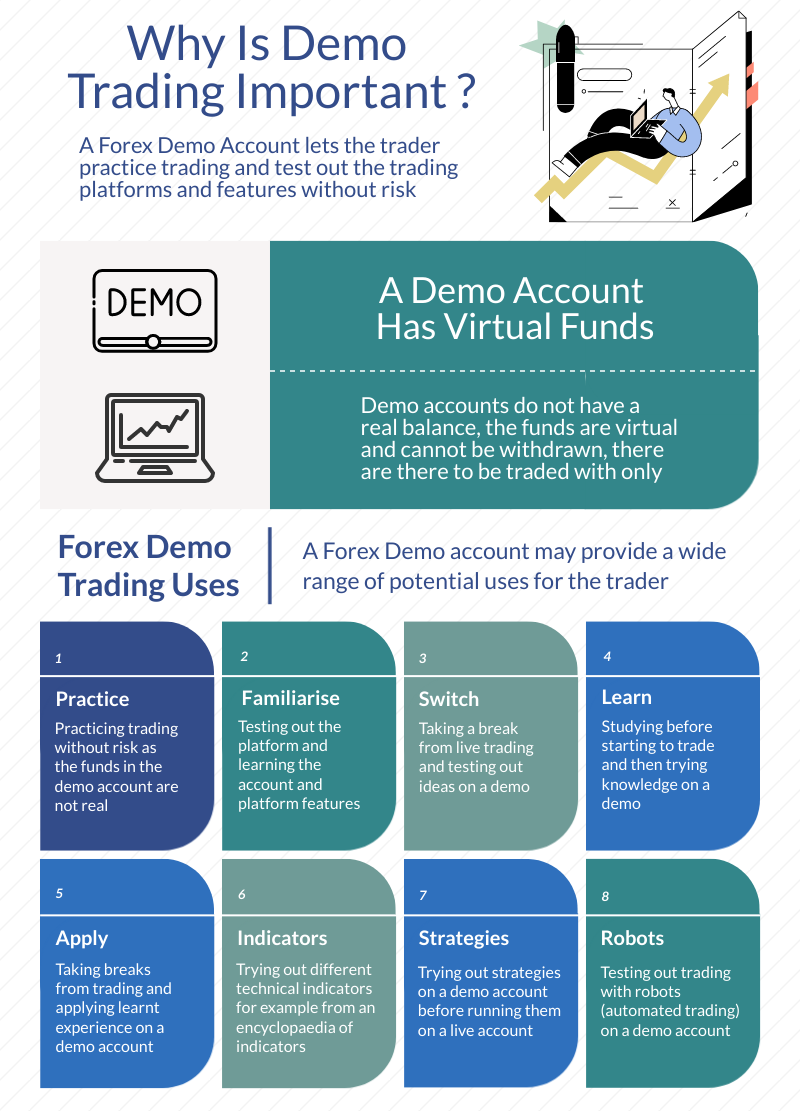

A demo account allows the trader to use the platforms and features of the provider, without making a deposit. Demo accounts will have virtual funds included and also allow the trader to practice trading even after they have opened a live account. What is best can depend on a wide range of factors however an attempt to simplify by looking at what a demo account can do and then exploring broad categories of Forex trading, will be followed here.

A demo account can be opened at a provider either as a separate account or as part of the account opening process or afterwards. That is, the trader may apply for a demo account as a separate application but is some cases may be given access to the platform after initial sign up, as a demo account.

A demo account does not contain real money, it does contain virtual funds, which cannot be withdrawn, they are there simply to be traded with, to simulate the experience of trading on a live account (demo accounts are sometimes called 'trade simulators'). This has a potential downside, in that the virtual funds are normally relatively substantial and may be significantly more than the amount the trader will deposit to the live account. Why this matters is that a well funded account might traded on differently than an account which is funded with much less real capital.

When properly managed a more sizeable account allows greater room for retracements, which is a common and repeated experience of Forex and other leveraged trading, that is the trade moves against the traded position.

While a loss or gain is not realised in an account until the position is closed, as a loss mounts it can trigger a limit set by the trader or by the account (for example a stop-out). So how much room there is in terms of the value of the positions versus the account size and how much this can change, can be a critical factor when trading.

A larger account therefore might be traded differently than a smaller account and this may not be apparent until a live account is used. One way to tackle this issue is to start with small trade sizes on a live account. Also, the fact the funds are not real may have an effect on the level of risk taken.

This said, it is normally worthwhile to use a demo account initially. It will provide experience with using the platform, with the mechanics of making a trade and offer a platform for actually placing trades, utilising the tools available, for example using a news feed or Economic Calendar for fundamental analysis or trading on a technical basis with indicators, trend lines and graphical objects.

As well as offering a way to practice trading, a demo account can provide a way for the trader to try different types of Forex providers and find one aligned with their interests. A selection of providers with different types of features is chosen, to provide a choice for a demo account and point the way to a best fit.

These categories are firstly, Automated Trading Provider, for those seeking a provider with a focus on automated trading. The automated trading features can be tried and tested on a demo account. Secondly, Small Trade Sizes, for those who want to try a demo at a provider which offers accounts with small minimum trade sizes. Thirdly, Wide Range Of Features, for those who may have interests in the wide range of ways Forex is traded.

Wide Range Of Features AvaTrade

- Minimum deposit: $100

- Online trading platforms: MT4, MT5, Web Trader, AvaTradeGO

AvaTrade aims to offer support for different types of Forex trading, incuding automated trading, discretionary trading where the trader makes their own trades, mobile Forex trading and Forex social and copy trading. User friendly desktop and mobile platforms are offered, as well as MT4 and MT5 and a range of social and copy trading platforms. For live trading, features such as AvaProtect, which reimburses for losing trades, T&Cs apply, are available.

Small Trade Sizes XM

- Minimum deposit: $5

- Online trading platforms: MT4, MT5

XM is a long standing CFD provider offering MetaTrader. Both MT4 and its successor MT5 are available. The trader can test out this provider, its platforms and account features on a demo account. When ready, they may then apply for a live account try out XM's Micro account with very small trade sizes and a low minimum deposit. Trade sizes down to 0.0001 standard lots are available and the minimum deposit for this and other accounts is $5.

Automated Trading Provider Dukascopy

- Minimum deposit: $1000

- Online trading platforms: MT4, JForex

Dukascopy Bank is a Swiss regulated Bank offering CFD trading. Dukascopy Bank provides MetaTrader 4 and JForex. Both platforms support automated trading, however they use different programming languages for making robots. Traders can trade Forex on user friendly JForex, utilising its automated trading facilities as well as its user friendly interface, with a relatively large number of inbuilt technical indicators. Live accounts are available denominated in Gold, as well as fiat currencies.