Forex copy trading allows the trader to have the trades of a selected trader copied in their own account. Copy trading can be a way to let more experienced traders make copied trades in the complex Forex market, however a trader who has performed well in the past will not necessarily do so in the future.

Copy trading can be seen as part of a Forex trader's toolbox, along with trading without copying to try and increase experience, or utilising robots to implement an automated trading strategy. A selection of Forex brokers offering copy trading is provided below, as well as a longer article and an infographic about the process of copy trading.

| Online Provider | About | Minimum Deposit | Forex Trading Platforms |

|---|---|---|---|

| Forex Copy Trading PlatformsIC Markets | IC Markets offers Forex trading, supporting automated trading and offering VPS hosting but also provides a wide range of copy trading platforms including Myfxbook AutoTrade, ZuluTrade, IC Social and cTrader copy Trading About | $200 Minimum Deposit | MT4, MT5, cTrader Forex Trading Platform |

| ZuluTrade Copy TradingZuluTrade | ZuluTrade is a user friendly, visually appealing third party social and copy trading platform which is offered through providers About | $100 Minimum Balance | ZuluTrade Forex Trading Platform |

| eToro CopyTradereToro | eToro offers a multi-asset platform called CopyTrader, so as might be expected it has a focus on copy trading. eToro provides social trading tools, for those who want to inform their trading with the views of others in its user friendly platform About | $50 Minimum Deposit | CopyTrader Forex Trading Platforms |

| Forex Social Trading PlatformVantage | Vantage provides a wide range of social and copy trading platforms, including Vantage Social Trading, Myfxbook AutoTrade, DupliTrade and ZuluTrade. Vantage Social Trading lets higher performing traders be copied, with the potential to earn, T&Cs apply About | $200 Minimum Deposit | MT4, MT5, ProTrader Forex Trading Platforms |

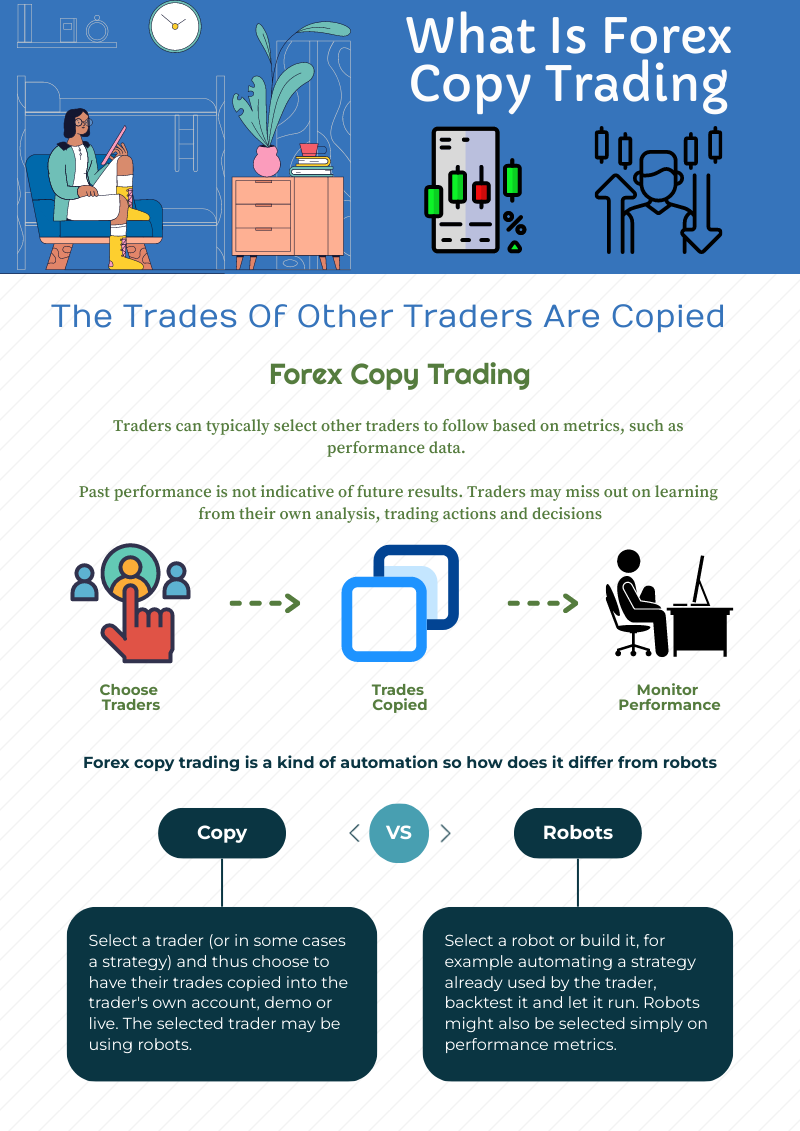

Copy trading is using software to copy the traders of other traders. Forex is a complex market and traders may wish to follow more experienced traders this way. Robot trading is another relatively hands off approach traders use in Forex and therefore this page looks at Forex copy trading in this, and other contexts.

The Forex market is arguably difficult to trade. It evidences complex patterns composed of moves and counter moves or retracements. It can produce complex patterns instead of directional moves when it reaches support or resistance, for example. One way of dealing with this complexity is to use robots, which is seen as an advanced method. Another way is to copy trade, which can be viewed as a potential approach for a wide range of traders, including those less experienced. When copy trading, the trader essentially gives up their decision making to another trader.

When robot trading the trader also gives up their decision making, but to a computer program. A difference is that the robot may be implementing a strategy the trader has designed or is familiar with. However traders may also use robots without understanding what it is the robot is doing. The trader chooses traders to copy based on performance parameters (which can also be the case with robots). However because a trader (or robot) was perfoming well does not mean they will continue to perform well.

Trusting another trader is like trusting a robot, though it might be assumed that to trust another trader is to trust human based trading, but the followed trader may actually be trading with robots. Assuming that performance equates with advanced trading, then to copy trade may be to follow advanced strategies which the trader either would not be capable of implementing or would not know about.

The description of the trader or strategy being followed can provide pointers to what it is the copy trade will be copying. However this said, to copy trade it to trade into a kind of black box, and the trader may miss out learning from their experience. Copy trading can therefore be seen as part of the toolbox of traders, with the aim of also enhancing their own capabilities, as well as providing the capacity to trade with more experienced and expert traders.

Social trading generally comes with copy trading, in one form or another. Social trading is a way to inform trades with the views and ideas of other traders, so it can be a way into copy trading, without giving up control. It might be said that in general, knowledge goes someway to tackle Forex, that is understanding what it is one is doing and why one is doing it, as well as what might happen when doing this (which tends to come from experience). In general in Forex it is difficult if not impossible to say that an outcome will happen, but it may be possible to say that there may be a number of outcomes, that is to prune the potential outcomes.

A selection of Forex providers which support a range of Forex trading and offer copy trading platforms are to be found on this page. This can enable the trader to use copy trading within the context of a Forex toolbox of techniques to try and tackle this complex market.

Copy Trading Platform eToro Copy Trader

- Minimum deposit: $50

- Online trading platform: CopyTrader

eToro is a long established and well known provider offering social and copy trading on a user friendly multi-asset platform. eToro provides Forex CFD trading on this platform, allowing traders to follow other Forex traders or see their views and ideas, as shared via eToro's social trading tools. Traders are ranked according to wide range of performance metrics, to provide a basis for choosing a trader to follow.

Forex Copy Trading Platforms Vantage

- Minimum deposit: $200

- Online trading platforms: MT4, MT5, ProTrader

Vantage offers Forex copy trading on the Vantage Copy Trading platform, DupliTrade (which connects with MetaTrader), ZuluTrade and Myfxbook AutoTrade. Vantage provides trading infrastructure to support a wide range of types of Forex trading, from automated trading, to trading where the trader makes their own decisions as well as social and copy trading.

ZuluTrade Copy Trading ZuluTrade

- Minimum balance: $100

- Online trading platform: ZuluTrade

ZuluTrade is a well known platform dedicated to social and copy trading, which uses its algorithm to rank traders by performance, behavior, stability and outlook. While the minimum deposit depends on the connected provider, the trader's balance should always be higher than $100 to stay connected with ZuluTrade.

Forex Copy Trading Platforms IC Markets

- Minimum deposit: $200

- Online trading platforms: MT4, MT5, cTrader

IC Markets offers account for traders who trade using online trading robots. It has Forex spreads from 0, plus commission. Traders who trade on their own behalf can also use IC Markets.

IC Markets offers a wide range of copy trading platforms. These include Myfxbook AutoTrade and ZuluTrade, which are third party platforms. Also provided is IC Social, which is IC Market's branded copy trading platform, powered by Pelican Trading, for MetaTrader. Those who want to copy trade on user friendly cTrader, can use cTrader Copy Trading.