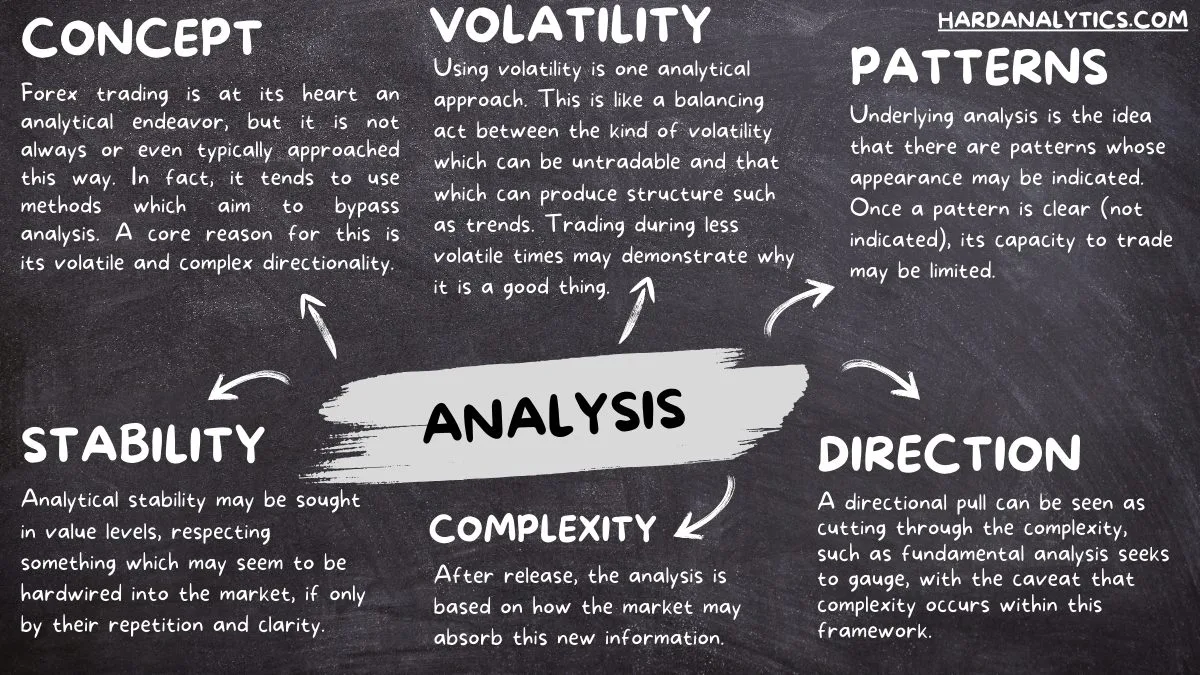

The problem with Forex analysis is that the more detailed it is, the less it can take account of multiple outcomes (due to increases in complexity) and the less detailed it is, the less useful it may be for projecting outcomes. So is there a golden mean in this.

Underlying these issues is the problem that there is an unpredictability in Forex. This emerges from the issues inherent in accounting for the influences of incoming data (either the nature of the data or its effect), which is to say the underlying issue with fundamental analysis and from inherent technical issues, which is to say that structures used to predict action may take different forms as they emerge.

If a prediction is being made based on the shape of something and this shape changes, then the prediction can be invalidated. However the prediction itself could be constrained in terms of possible outcomes, which is a way to treat Forex analysis. This means that trading takes on a more dynamic form, where the trader may adjust the trade on the basis of emerging and altering expectations, based on shape formation and deformation. This is an argument for discretionary trading, contingent on the way the Forex market alters form.

Underlying this idea is the concept of constraints on outcomes, that is while each event may have different outcomes, the weight of past events may act as a restraint on the outcome paths which might emerge from any formation. This itself is an argument for multi-time frame analysis, as it helps gives an overview on restraints on a particular event. These restraints are a by product of the way support and resistance take on different perspectives and importance when viewed on different time frames.

Issues with data effects and formation changes are potentially related, even two sides to the same coin, as the capacity for different outcomes may be predicated on the effect of data. As suggested it is not merely a matter of not knowing what the data is, it is also the issue of knowing what the effect will be. In news trading this is revealed as the range of reactions which can happen, which may not make causal sense, but which can still be explained after the event, like the way patterns seem clear after they are formed.

To see why this is problematic, it is necessary to consider the mental state prior to the news event and then the alteration which happens as the data is released, an adaptation to the present, which may in fact obliterate the expectation. This is why trading into the news or trying to be very dynamic towards the Forex market in more regular trading, tends to be a pull on the trader. But riding the market can be problematic, as it is difficult being buffeted back and forth. Which is why robots are used. Robots encompass an idea that it will work out, but there may be deep retracements, which underlies somewhere an idea that it is possible to find analytical structures in the Forex market which predict direction over time.

So all this comes back to the focus that in the Forex market is a kind of bias towards finding directionality, which is suppressed a lot of the time. Hence near 'perfect' trends which appear from nowhere. It may be the task of the trader to look for the potential for this directionality to emerge, that is for a Forex pair to revert to form, in the midst of myriad influences on it. This itself may be an argument for technical analysis, as this is what this craft essentially aims to do, rather than predicting a given event at a given time.