Trade CFDs On Mobile

|

|

Deriv EZ Review

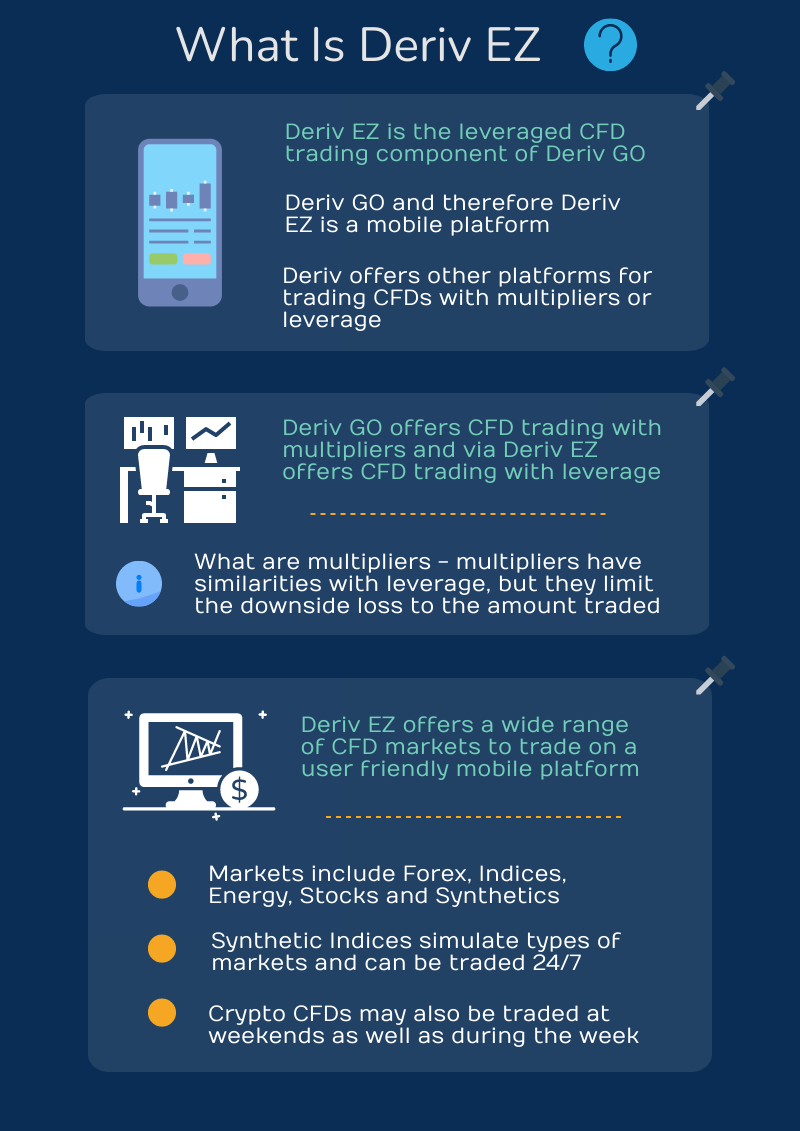

Deriv EZ is a CFD trading platform integrated into the Deriv GO mobile app. Deriv EZ complements the other platforms offered at Deriv, in that it provides a dedicated mobile CFD trading platform. Deriv GO is based around multipliers, while Deriv EZ is based around leveraged trading.

Deriv was formerly known as Binary.com. The Deriv platform is a user friendly suite of online trading platform, covering a wide range of types of trading. Deriv GO is the dedicated mobile app, though the other platforms have mobile versions as well.

What is Deriv GO ?

Deriv GO is Deriv's mobile trading app, designed to provide an intuitive trading experience. Deriv GO was dedicated to trading CFDs with multipliers. CFDs offered include CFDs based on real market and synthetic markets. Synthetic markets simulate different market conditions and are available to trade 24/7. However Deriv GO provides Crypto CFD trading, which is also offered 24/7. The other CFD markets follow the underlying market hours.

Deriv GO can be downloaded from the relevant app store. However to use it, the trader enters their Deriv credentials. So the trader can sign up with Deriv, check out the platforms, download Deriv GO from the app store (the link is available from the 'Trader's hub' on Deriv) and trade with their Deriv sign in. The Deriv platform offers a wide range of other trading platforms platform including MT5.

What is Deriv EZ ?

Deriv EZ is a CFD trading platform, with 100+ markets to trade.

What is the relation of Deriv EZ to Deriv GO ?

Deriv EZ is integrated into Deriv GO. The trader creates both real and demo EZ accounts from the Deriv GO app. The trader can then switch easily between these accounts, to trade CFDs on multipliers (Deriv GO) or as leveraged markets (Deriv EZ).

What markets are offered to trade on Deriv EZ ?

Forex, Indices, Energy, Stocks, Basket Indices, Cryptocurrencies and Synthetics CFDs are available to trade on Deriv EZ. Basket Indices are based around a basket of currencies. Synthetics are algorithmic markets, which simulate different types of market conditions. On EZ, Synthetics include Volatility Indices and Crash/Boom Indices. Volatility Indices simulate different levels of market volatility. Crash/Boom Indices simulate rising (Boom) and falling (Crash) markets.

Additionally Deriv EZ offers DEX UP Indices and DEX DOWN Indices. These are relatively new Synthetics which simulate markets with sharp rises (UP) or falls (DOWN), in times of 600, 900 or 1500 seconds. Essentially they simulate sharp rises up or down, following a more mixed volatile move in the opposite direction. This is a type of volatility which can be seen in real markets especially around new events, but this is nonetheless a simulation of this kind of market volatility. They are available down to 0.01 lots.

Deriv introduced the DEX Indices on EZ first, and is now doing the same with a new Index type, the Drift Switching Indices. These come in three types: Drift Switch Index 10, Drift Switch Index 20 and Drift Switch Index 30.

Are Synthetics traded differently from other CFDs ?

Synthetic Indices are not based on an underlying real market, unlike the other CFDs. This said, they are traded the same way as other leveraged CFDs. That is, the trader sets a volume or trade size and opens a position. The trade is open ended and both profits and losses are unlimited. Because of this the trader will exercise risk management, encompassing such factors as a stop-loss, position size management, profit targets, margin management, exit strategies and last but not least analysis to provide a basis for the trade.

There are 50+ technical indicators available to help provide suggestions for entry, trade management and exits. If the trader feels that they would prefer to trade on a wider screen, then they can find margin trading of CFDs, real and synthetic on Deriv X and the powerful MT5 platform. MT5 has a wide range of tools, and allows automated trading. Deriv X is user friendly and designed for those who plan and execute their own trades.

However Deriv EZ is aimed at a mobile first trading experience and aims to be intuitive and clear as much as this is possible. When mobile trading, it can be helpful to analyse on a desktop first and get a trading plan from this perspective. Mobile trading can be handy in that the trader can, in theory, have access to their trades in their pocket, as it were.

| Feature | Description |

|---|---|

| CFD Trading Feature | Leveraged trading of a wide range of CFDs is offered on Deriv EZ Description |

| Mobile First Feature | Deriv EZ is Deriv's mobile platform for trading CFDs on margin, and is to be found on the Deriv GO app Description |

| Synthetic Markets Feature | As well as CFDs based on real markets, synthetic markets are available, which are based on algorithms Description |

| Crypto CFDs Feature | A wide range of Crypto CFDs are offered Description |

| Weekend Trading Feature | Both Crypto CFDs and Synthetics can be traded at weekends and during the week Description |

Crypto CFD Trading

Cryptocurrency CFDs are offered in Deriv EZ. When trading a CFD, the trader does not own the underlying markets. These are available with leverage up to 200:1. Cryptos CFDs offered (subject to change) include: ADA, Algorand, Avalanche, BAT, Bitcoin Cash, BNB, Bitcoin, DOGE, DOT, Ethereum Classic, Ethereum, Filecoin, IOTA, LINK, Litecoin, Maker, Metacoin, NEO, OMG, Solana, Uniswap, XLM, Ripple, Tezos and Zcash.

Stocks CFDs

A range of popular Stocks CFDs are offered on Deriv EZ.

What charting tools are available ?

The trader can add technical indicators to the chart from the settings tab on the chart.

There is a wide range of indicators available. A wide range of chart types is also on offer, which include Candlesticks, Hollow Candlesticks, OHLC, HLC, Line, Area, Dots, Histogram, Columns and Line And Dots.

Is there a demo account ?

There is a demo account. The trader can make both demo and real accounts. The demo account has a $10,000 balance of virtual funds. This is not real money, and cannot be withdrawn.

When using a demo account, the trader might be mindful of the fact that they may trade on a live account with smaller sums. The account size plays a role in the amount of drawdown, for example, an account can endure (so there can be a difference between trading on real and demo accounts).

With the demo account, the trader can try out the Deriv EZ platform and test run trades and practice trading at any stage, by switching from live to demo. Deriv Sign-Up

What is the maximum leverage ?

Maximum leverage depends on the market traded and the trader's region, but the maximum available for Forex is 1000:1. Some Synthetics can have higher leverage, for example up to 4000:1 (increasing leverage increases risk). The more volatile the Synthetic, the lower the leverage tends to be.

Please note that in some regions, the maximum leverage can be considerably lower. The trader can consult the info box at the tip right of the market. This will will show the salient features of each market, including leverage, volume and opening hour.

What is the minimum trade size ?

The minimum trade size varies depending on the market, but the minimum available is 0.001 lots (for Volatility 75 Index). A minimum volume of 0.01 or more lots is more typical.

Analysis with technical indicators

As there is a wide range of indicators, the trader can try technical trading on this platform. Technical indicators are used to try and establish a rationale for a trade. So they may point towards overbought or oversold conditions, volatile conditions and so on.

As a guide for what each may do, the trader can consult a wide range of books including an encyclopedia of indicators. Technical indicators have no guarantee of working and in fact can be wrong. But they still can offer a rationale for a trade, even if it does not work out.

What is the minimum deposit to use Deriv EZ ?

It depends on the payment provider, but the lowest is $5. However if the trader is in a region offering Crypto denominated accounts, there is no minimum deposit.

Payment methods include Credit/Debit Cards, Bank Transfer, Skrill, Neteller, Fasapay, Perfect Money, WebMoney, Paysafecard, Jeton, Sticpay, Airtm, Pay Livre, OnlineNaira, Trustly, Beyonic, AstroPay, 1ForYou and Advcash (payment method availability depends on the trader's region).

Crypto accounts are available, covering Bitcoin, Ethereum, Litecoin, Tether and USD Coin. For Crypto accounts, Changelly, Banxa and XanPool are also available.

Comparative study

There is a wide range of mobile platforms out there for trading CFDs. Mobile platforms include those which work on mobile browsers and those which have a dedicated app. Deriv EZ is a dedicated app and compared with other Deriv platforms, is the new go to in this sense for mobile CFD trading with Deriv.

Deriv EZ is within the Deriv GO mobile app, but is separate in that it requires a new account to be made from Deriv GO. When this happens the platform can be used for multipliers or leveraged CFDs. MT5 is offered by Deriv and has its own mobile app, which can be used for Deriv MT5.

The Deriv EZ app aims to provide clear, readable charts (which can be particularly helpful for mobile) and it has to be said that the addition of indicators does not detract from this clarity. In terms of other mobile apps, there are very user friendly apps out there for trading CFDs, however Deriv does also offer an unusual range of markets (subject to availability).

Why trade CFDs on Deriv EZ ?

Deriv EZ brings Deriv's approach to CFD trading to a dedicated mobile app. The app was providing multipliers trading only, but now covers both multipliers and leveraged CFDs, with the addition of a Deriv EZ account.

This is a mobile first, user friendly platform with clear readable charts, and offering a wide range of types of markets to trade and technical indicators to analyse these markets.

There is a demo account, a low minimum deposit and depending on the traders, region, substantial leverage available. Traders can trade on weekends, with a Crypto CFDs and Synthetic markets.