What is (speculatively) the most important thing in trading ? In principle entry is straightforward, that is there can be many reasons to enter at a certain time and value. However once entered the trader is stuck, and also potentially stuck emotionally. Being emotionally stuck can lead into emotional trading, so it can be important to find a logical basis in a market which can seem illogical.

Traders often enter at a point that other traders are entering (and others therefore exiting) and find the position then moves against their traded position. Traders may enter at resistance as well, especially if trading on momentum. Easy to get in, hard to get out.

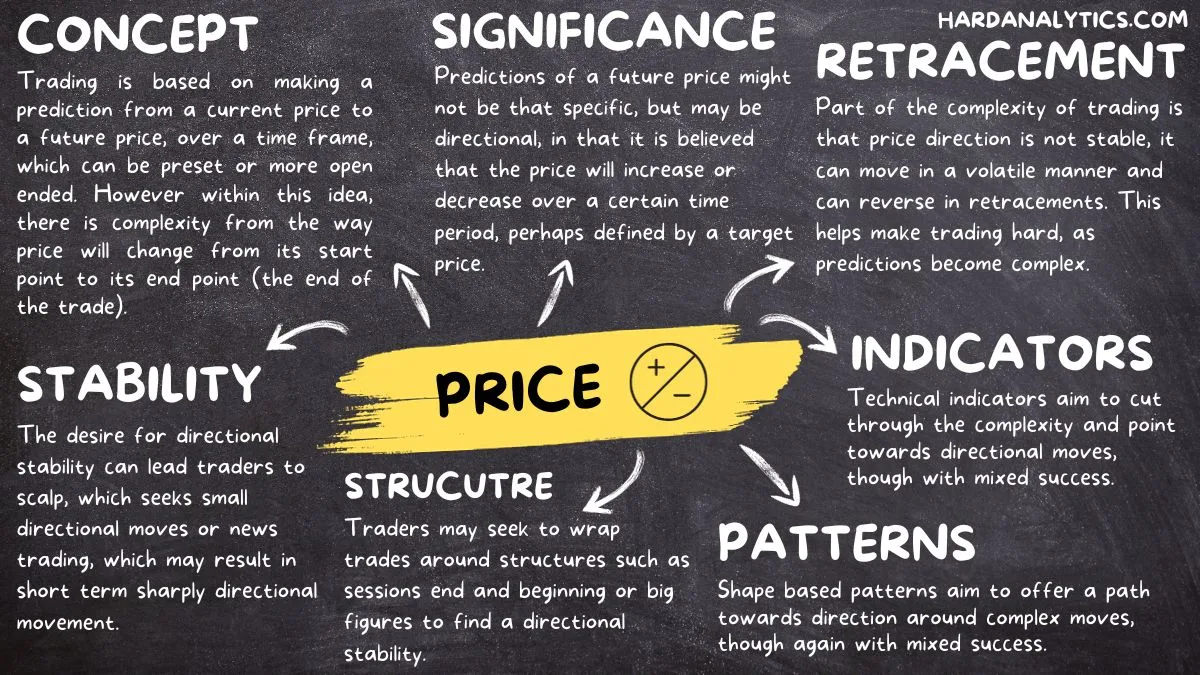

So one way to approach trading is to enter in such a way that there is an exit in mind. That is, the entry point will help determine the exit point. If the trade idea clearly is not happening the trade can be ended, either by setting a stop loss in this region, or manually. However the problem with doing this is that Forex is complex and can find that direction at a later time than expected or hoped for. This is why the trader needs room in their account to withstand retracements against the trade.

This process can be made more intricate, in that the trader may examine patterns forming and see if they are consistent with the possibility of a move being a reversal or a retracement (or dip) which will continue in the traded direction. That is, trades need to be managed. This itself can be a dfficult and sometimes fraught process as patterns are only apparent after they form, up until this point, they can potentially branch into other patterns. There is a random element to the market which allows for alterations in patterns.

It is possible to use robots to trade a given strategy and to take in the retracements and even reverals as drawdown. However drawdown can be steep and the trader may wish to use their discretion when trading.

There are technical indicators which aim to provide a sense of market volatility. This can help with trading scenarios where the market is lacking volatility and just trending about for an extended period or is highly volatile and prone to irregular movement which can take out a stop loss. An economic calendar can suggest market times and markets which may be affected by news releases and turned into frothing volatility. Not consulting a calendar can result in this: a move which comes from nowhere surging the market or making is oscillate. However news may be unannounced and sudden and the market can react in unexpected ways at any time.

So is it possible to have a game plan of some kind when entering, or even a standardised plan ? This is what trading strategies do, they provide one, with a reassurance based on what has happened in the past. However strategies often do not work out and if the trader is applying a strategy and sticking to its rules, then they may consider using robots. The element of discretion is to allow this plan (trading strategy) to be adjusted as necessary by actual market conditions. However trading is based on future outcomes and these are not apparent typically from the current state of the market. So the past becomes the guide, that is the preponderance of outcomes suggested by a given market structure and formation.

This intense uncertainty, that is using past patterns to project an outcome into the future, is at the heart of the difficult of trading. Knowning this is perhaps the most important thing. That is, the unexpected outcome is potentially the likely outcome. There are many approaches to trading which seek to limit the uncertainty, including news trading, which ties down time and news to suggest potential oucomes, high frequency trading, which seeks to trade on micro movement in the market, arbitrage which seeks to exploit some kind of irregularity in the market, scalping which seeks to trade on small movements and using patterns and value levels to try and enter nearing support and exit approaching resistance. All these approaches have issues, which comes down down to uncertainty hard wired into the market.

The uncertainty is partly a consequence of the many different perspectives of traders and systems in the market, including exit and entries which make sense to the trader or system, but would not make sense to another trader. This is at the heart of market irrationality, that it contains so many perspectives and ideas about what that future projection is or what part of it is important. Sometimes these factors converge in market momentum and such times are perhaps the most logical times in the market (even if founded on irrational exuberance or dismay). More structured examples of these moments can include a trend forming, finding structured movement and then ending. These are patterns which can be traded on, particuarly looking for the beginning and the end. However the uncertainty is always there.