| Online Broker | Minimum Deposit | Trade Synthetic Indices | Trade Forex |

|---|---|---|---|

| Deriv | $5 Minimum Deposit | 24/7 Trading Of Volatility, Crash/Boom, Hybrid, Range Break, Step, Multi Step, Skew Step, Jump, DEX and Drift Switch Synthetic Indices Synthetic Indices | Forex Trading On MT5, cTrader and Deriv X with leverage up to 1000:1 Forex |

Synthetic Indices vs Forex - Differences & Similarities For Traders

Synthetic Indices are simulated markets. They specify types of markets, for example, based on volatility or bull and bear markets. Forex is a real market, though generally traders trade CFDs which are based upon it, without owning any Forex.

| Trading Feature | Synthetic Indices vs Forex | Description |

|---|---|---|

| Trading Times Trading Feature | Trade 24/7 vs Trade Sunday to Friday Synthetic Indices vs Forex | Forex CFDs are based on Forex Pairs and the market is open continuously during the week, but closes on the weekend, while Synthetic Indices are not based on real markets and are open 24/7 Description |

| Trading Analysis Trading Feature | Market Conditions vs Currency against Currency Synthetic Indices vs Forex | Forex Pairs are the relative valuation of one countries currency against another, thus allowing fundamental analysis, while Synthetic Indices simulate market conditions such as volatility, but both allow technical analysis Description |

The Forex market is a huge market where currencies are valued against each other, in Forex pairs. It is not possible to pre-specify market conditions with Forex, though traders may expend effort in attempting to do so, that is by looking for Forex pairs that may be more or less volatile or trading into market conditions that may be more or less volatile.

A Synthetic Index attempts to simulate an entire type of market, akin to the way a Stock Index has a more generalised focus than an individual Stock. This said, Forex pairs tend to reflect entire economies and can be affected by data released by these economies. This provides space for both technical and fundamental analysis.

However to a significant extent analysis aims to identify levels of expected volatility, as well as direction to emerge from these market conditions. As Synthetic Indices aim to let the trader specify market conditions such as volatility, then it might be said that the fundamental analysis is part of the choice of which Index to use. But there is no external reference for the Index in the way that there is for a currency (allowing for fundamental analysis), as they are algorithmic. However, Synthetic Indices can be analysed using technical tools like indicators and graphical objects on the chart.

| Broker | Trading Platforms | Description |

|---|---|---|

| Deriv Broker | Deriv X, Deriv Trader, cTrader, SmartTrader, MT5, Deriv GO, Deriv EZ, DBot Trading Platforms | Deriv offers 24/7 Synthetic Indices trading across a range of platforms in an intuitive interface & provides Forex margin trading (and Synthetic Indices trading) on MT5, cTrader, Deriv EZ and user-friendly Deriv X Description |

Synthetic Indices have to use an algorithm to generate value for them, within the constraints of the type of market conditions they are designed to simulate. This is based on random numbers, so underlying a Synthetic Index is randomness, structured to reflect volatility levels or other market conditions.

Whether the Forex market is random or not may not be known, however, there may or may not persistent structure within it. The myriad factors that make a Forex pair change value may amount to a random event but are structured as well. To some extent, trading analysis aims to identify this.

However the idea of Synthetic Indices is that they are also structured by the type of market conditions they simulate and will trace out charting patterns. So in both cases, the trader may be trading on structured randomness, which appears to have recurring regularities. For this reason, there is no certainty with which any technique can be applied to the Forex market and it can be assumed that this is the case with Synthetic Indices, if their basis is random.

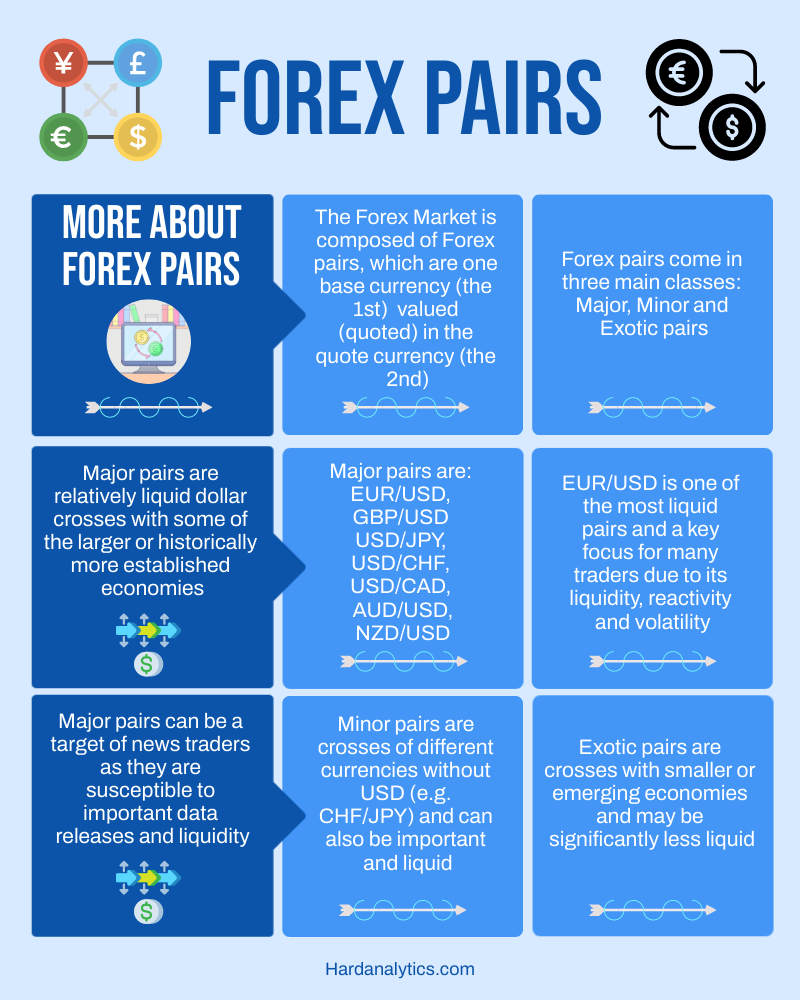

The Forex market has a relatively large number of Forex pairs to trade, compared with most other markets (but not the Stock market). Brokers tend to offer 20+ to 100+ pairs (with 60+ not untypical). A Forex pair offering is defined by the Major Pairs and Minor Pairs along with Exotic pairs, which are types of crosses of different pairs. So the number of pairs is dependent on the range of crosses offered, which can be quite extensive if a wide range of more Exotic currencies are crossed.

However Synthetic Indices are generally not so numerous, and are limited to categories of volatility or market types. This said the broker analysed here, Deriv has expanded its offering so that it now provides a wide range of these simulated markets, especially if different types within categories are considered (for example Volatility Indices come in different volatility levels and speeds). The table below indicates this range of Synthetic Indices. So Forex pairs reflect the capacity to create pairs from currencies, while Synthetic Indices reflect the capacity to algorithmically simulate types of markets.

| Synthetic Index | Deriv Platforms | Description |

|---|---|---|

| Volatility Indices Synthetic Index | Deriv Trader, SmartTrader, DBot, MT5, cTrader, Deriv GO, Deriv EZ, Deriv X Deriv Platforms | Volatility Indices simulate different levels of market volatility Description |

| Crash Boom Indices Synthetic Index | Deriv Trader, Deriv GO, Deriv EZ, MT5, cTrader, Deriv X Deriv Platforms | Crash Boom Indices have a drop (Crash) or spike (Boom) every 300, 500, 600, 900 or 1000 ticks on average and come in Crash 300, Boom 300, Crash 500, Boom 500, Crash 1000 and Boom 1000 types and on cTrader Crash 600 and Boom 600 and Crash 900 and Boom 900 types. On some platforms, the Hybrid Indices are offered, which are Crash Boom Indices with 20% volatility Description |

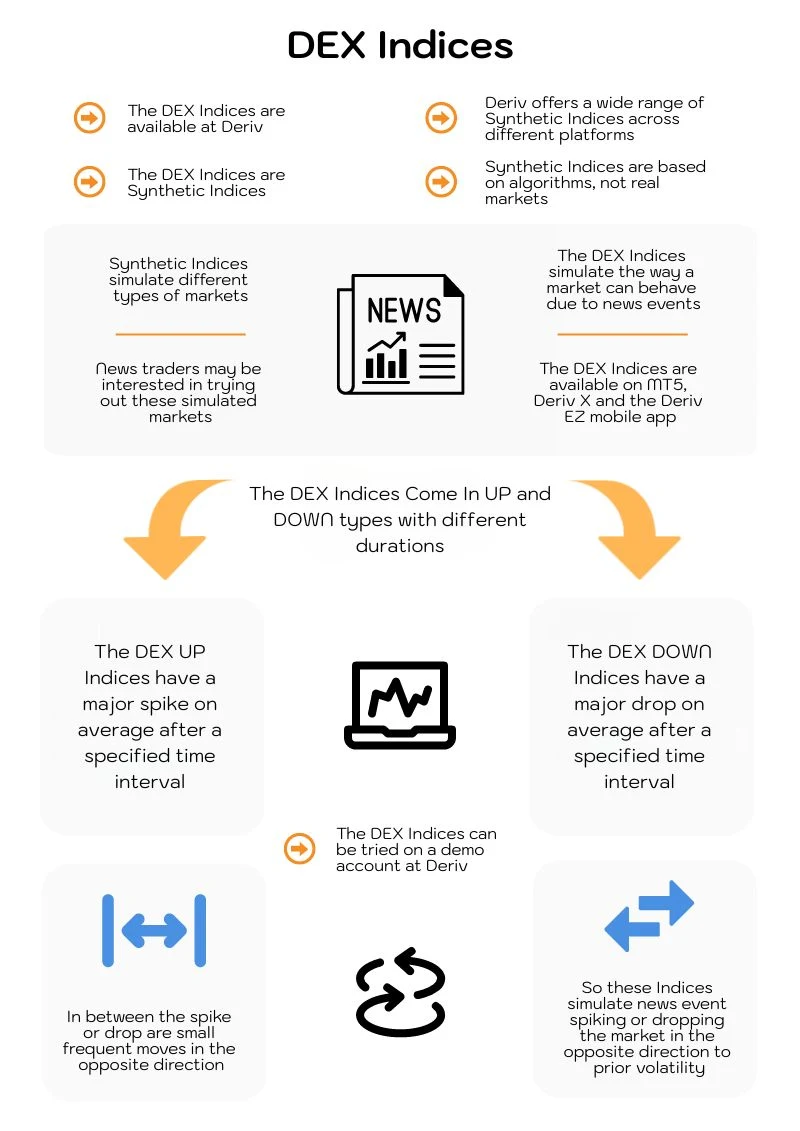

| DEX Indices Synthetic Index | MT5, Deriv X, cTrader, Deriv EZ Deriv Platform | The DEX Indices come in six types, DEX 600 UP, DEX 600 DOWN, DEX 900 UP, DEX 900 DOWN, DEX 1500 UP and DEX 1500 DOWN and simulate sharp upwards moves or downwards moves. These are offered on Deriv EZ, Deriv X and MT5 Description |

| Drift Switch Indices Synthetic Index | Deriv EZ, Deriv X, cTrader, MT5 Deriv Platform | The Drift Switch Indices come in three types: Drift Switch 10, Drift Switch 20 and Drift Switch 30 Description |

| Daily Reset Indices Synthetic Index | Deriv Trader, SmartTrader, DBot Deriv Platforms | Daily Reset Indices are the Bull Market Index and the Bear Market Index, which simulate these market conditions Description |

| Step Indices Synthetic Index | MT5, Deriv X, cTrader, Deriv EZ, Deriv Trader Deriv Platforms | The Step Indices simulates a market step by step, with each tick having an equal probability of being up or down. On some platforms, the Multi Step Indices are available, which have different step sizes, and the Skew Step Indices, which do not have an equal probability of up or down Description |

| Jump Indices Synthetic Index | MT5, Deriv X, cTrader, Deriv EZ Deriv Platforms | The Jump Indices come in five types (Jump 10, Jump 25, Jump 50, Jump 75 and Jump 100) with different volatility but each jumps three times per hour Description |

| Range Break Indices Synthetic Index | MT5, Deriv X, cTrader, Deriv EZ Deriv Platforms | The Range Break Indices break the range the market moves in once on average either every 100 attempts (the Range Break 100 Index) or once every 200 attempts (the Range Break 200 Index) Description |

Deriv is the broker chosen as it has long supported Synthetic Indices and has done so via Binary.com. Deriv is the rebranding of Binary.com and Binary.com has moved to Deriv. Feature availability and specifications can vary depending on the trader's region.

Deriv is a suite of online trading platforms based around Synthetic Indices and other CFD markets. Deriv Trader is a more user-friendly way to trade these markets, SmartTrader is the Binary.com classic platform, Deriv GO is a mobile app for trading markets including Synthetic Indices using multipliers, Deriv EZ is on the Deriv GO app and is for leveraged CFD trading, MT5 supports trading of simulated markets as well as CFDs based on real markets, as does user-friendly Deriv X, while DBot allows the trader to create robots using drag and drop based on simulated markets.

The trader may trade Forex CFDs and Synthetic Indices on MT5 at Deriv with leverage up to 1000:1 (increasing leverage increases risk), via the Deriv MT5 web trader, the full-featured MT5 desktop download and on the user-friendly MT5 mobile app as well as on Deriv X (a user-friendly desktop web trader and mobile app), Deriv EZ (a mobile app) and on cTrader, which has its selection of Indices. Some Synthetics may offer higher leverage. Maximum leverage can vary depending on the trader's region.

A final and important distinction between Synthetic Indices and Forex, is that the Forex market is open continuously from late Sunday to Friday evening (GMT), so CFDs based on Forex can normally be traded within this period. Synthetic Indices are not based on real markets and can be traded at weekends as well as during the week, 24/7.