Build Online Trading Robots With Drag And Drop

|

|

Deriv Bot Review

Deriv Bot (formerly DBot) is Deriv's drag and drop robot building platform offered on its suite of trading platforms. Deriv Bot lets the trader build and run online trading robots which will trade on behalf of the trader, with no cost. Deriv Bot does not require the trader to code. The trader may use pre-built strategies such as Martingale or can build complex robots from a wide range of parameters.

Deriv aims to create a more intuitive trading experience, packaging a range of platforms from user friendly Deriv Trader to MT5. Deriv Bot began as part of the Deriv platform available from Binary.com (and originated from Binary Bot, which is still available at Deriv).

Binary.com has rebranded and moved to Deriv. Traders who want to build robots based on Synthetic Indices without coding and using an intuitive platform, may wish to try out Deriv Bot. The minimum deposit for Deriv is $5 and the minimum order size for Synthetic Indices is $0.35. Deriv Sign-Up

How does the trader create a robot on Deriv Bot ?

Firstly, the trader clicks on Deriv Bot from the Deriv main drop down menu. The trader then will find a tutorial running to show how to use the basic elements of the platform. It is a good idea to click through on this first.

After this, the trader will find themselves on the Dashboard tab. This is simply a page allowing the trader to import a bot if they wish. If they are just starting and do not have a bot, then they will probably want to build one. Beside the Dashboard tab is the Bot Builder tab. This is where the trader can build their trading bot.

Next is the Chart tab, where the trader can examine clear charts of the markets available. Finally there is the Tutorials tab, where the trader can find guides, a FAQ and strategy building guides.

The Bot Builder tab

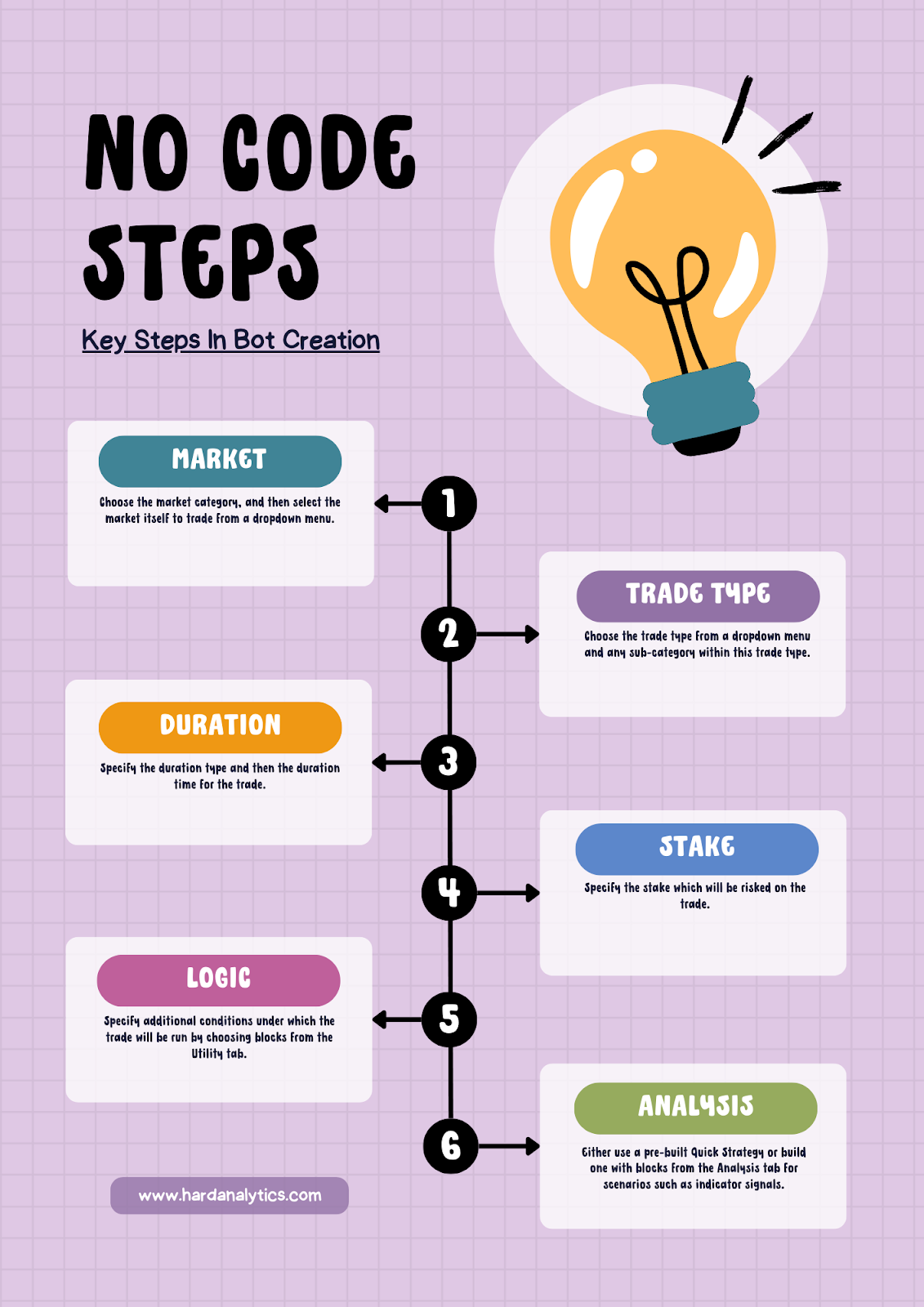

On the Bot Builder tab, there is a series of preset blocks with drop down menus. To create a robot from these blocks the trader follows a series of steps and then saves their robot if they wish.

Firstly, the trader selects a market, for example the Volatility 10 Index. Synthetic Indices are open 24/7, but when the following markets are open, it is possible to build a robot around Forex, Stock Indices and Commodities. Then the trader selects the trade type. The trade type is the format which the trader trades with. For example, they could select Up/Down.

Next they need to refine, for example selecting Up or Down or both. There are other parameters which can be set. Then the trader sets the duration. The next step is to set the Purchase Conditions and Sell Conditions. Then the trader sets Restart Conditions, for example based around profit or loss.

These instructions specify the type of option trade and parameters for it. This is like setting the trade parameters when setting up a trade, but the robot will run the trade for the trader. The trader can add additional logic to the trade. They can do this via the Utility and Analysis tabs on the left hand menu.

To run the robot, the trader selects the 'Run' button on the top right (and then it can be stopped here as well).

A robot like this will run and continue to execute trades (i.e. it automatically executes the steps a trader would otherwise execute). The advantage is that it saves the trader from continually making the trades, but it can also run up losses rapidly. However the trader can also execute trades via a strategy (for example based on a simple Moving Average crossover), or create more complex logic.

A range of blocks based on technical indicators can be found under the 'Analysis' tab (for example to configure strategies based on RSI, Moving Averages or MACD). To get the block, the trader moves the cursor to the strategy and presses the + button which appears. This provides a pre-set way to trade on a strategy, such as Moving Averages or Bollinger Bands. There is a wide range of blocks under 'Utility' to create finer grained blocks of instructions.

If the trader does not want to build at this level yet, the they can simply press the 'Quick Strategy' button on the top left and find a series of pre-built strategy templates. These cover 'Martingale', D'Alembert', 'Oscar's Grind', 'Reverse Martingale', 'Reverse D'Alembert' and '1-3-2-6'. These are automated ways to speculate on random events. So there are strategies pre-loaded, however the trader can also create them or customise them, using the same non-coding method based on building blocks. Again, strategies executed by robots may result in losses as the robot does not exercise discretion as the human trader can.

What is Deriv Bot for ?

The Deriv suite of platforms encompasses the range of ways to trade, which is to say options, multipliers and margin trading. Deriv Bot is for options, so it can create trading robots which trade via the trade types offered on Deriv's platforms (e.g. Up/Down).

Adding blocks and setting parameters

The canvas which the traders sees initially has a set of parameters and blocks. The trader can change these parameters from a menu (if it has one), for example choosing a market and can change and add new blocks. These blocks help define what will happen when the robot executes, along with the parameters within the block.

The blocks are code which help create the overall program for the robot. For example, the trader can remove the block from the 'Trade Again' parameter into the canvas, if they do not want the robot to run again once it has completed its instructions and add it back if they want it to keep on trading.

What is Deriv Bot based upon ?

Deriv Bot is based on a programming language called Blocky. When the trader specifies parameters and connects blocks (which represent programming code), they create an output which is syntactically correct.

Thus it allows the trader to construct code to perform a function without actually having to create this syntactically correct code themselves (which is part of what makes programming hard and time intensive) and do so visually by manipulating blocks.

24/7 trading

The simulated markets (Synthetic Indices) offered by Deriv are open 24/7, thus a Deriv Bot executing on a Synthetic Index can be run 24/7 (there is no need to rent a VPS).

Why use Deriv Bot ?

It is relatively user friendly method to do something which can be complex. There are other robot editors which allow the trader to create robots without coding, though some of the better known ones require the trader to learn a language. The advantage of learning a language is that it lets the trader get deeper into the functionality they may want.

But for many traders, they may simply want a robot to perform certain clear tasks, for example executing continuously around a simple moving average signal until told to stop. The trader may find doing this themselves tiring and a robot will tirelessly do it for them. And also many traders may simply run robots already built rather than programme them, but with Deriv Bot, they may be able to build them given its intuitive design.

In addition to this Deriv Bot is part of the Deriv suite. This has an overall aim of being intuitive and providing a wide range of platforms, from user friendly (Deriv Trader) to advanced traders (MT5 and cTrader). Deriv Bot perhaps has the aim of providing robot building tools to a wide range of traders, who might otherwise not feel comfortable building them.