| Online Broker | Minimum Deposit | Trading Platforms | Markets | About |

|---|---|---|---|---|

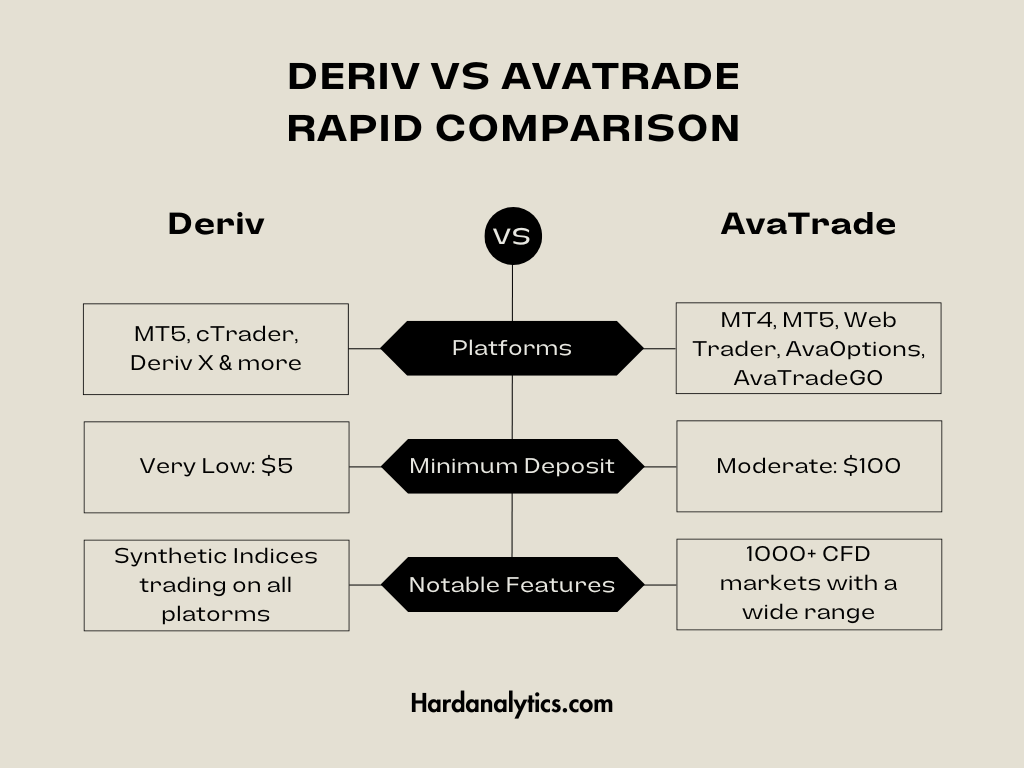

| AvaTrade | $100 Minimum Deposit | MT4, MT5, Web Trader, AvaTradeGO, AvaOptions Trading Platforms | 1000+ Markets To Trade | AvaTrade offers a wide range of features including social and copy trading and a user friendly web trader and well as both MT4 and MT5 About |

| Deriv | $5 Minimum Deposit | MT5, cTrader, Deriv X, Deriv GO Trading Platforms | 100+ Markets To Trade | Deriv offers margin trading on MT5 and user friendly Deriv X and supports copy trading via MQL5 Signals and cTrader Copy About |

AvaTrade vs Deriv Comparison

AvaTrade is a broker offering MetaTrader 4 (MT4) and its successor MetaTrader 5 (MT5). Deriv provides a range of trading platforms which includes MT5 and cTrader.

AvaTrade provides CFD trading based on real markets, while Deriv provides CFD trading based on real and simulated markets. Deriv offers different formats to trade markets including margin trading, while AvaTrade is for CFD margin trading.

Each offers dedicated mobile apps: AvaTradeGO in the case of AvaTrade and Deriv GO for Deriv. Deriv GO has a focus on multipliers, while AvaTradeGO is for leveraged CFD trading - i.e. it offers a user friendly mobile platform for trading its offering of markets. AvaTrade also provides a dedicated Vanilla Options CFD platform.

On MT5, AvaTrade provides considerably more markets to trade than Deriv (with 1000+ vs 100+). Deriv does however offer CFDs on synthetic markets (Synthetic Indices) in addition to CFDs on real markets.

Quick comparison

AvaTrade is an MT4 and MT5 broker, while Deriv is a suite of platforms including MT5, cTrader and user friendly Deriv X.

Minimum deposit and key account features

The minimum deposit for AvaTrade is $100. The minimum deposit for Deriv is $5.

- AvaTrade provides an Economic Calendar on its web site and Trading Central (which provides analysis). Additionally AvaTrade offers AvaSocial which supports social and copy trading. AvaTrade allows the use of EA trading robots.

- Deriv offers a range of platforms and account types packaged into one platform. On its user friendly platform Deriv X it offers features such as a Trading Journal. Copy trading is supported via MQL5 Signals and cTrader Copy. While this page focuses on leveraged CFD trading, Deriv does provide other types of trading, including multipliers and platforms. Some products may not be available in some countries.

Markets

- AvaTrade offers spread betting (in the UK), in Forex, Metals, Indices and Energy, with 35+ available.

- AvaTrade offers CFD trading in Forex, Metals, Indices, Energy, Cryptocurrencies, Stocks, ETFs, Options, Soft Commodities and Bonds, with 1000+ available on MT5.

- Deriv offers Forex, Metals, Indices, Energy, Cryptocurrencies, Stocks, ETFs and Options, with 100+ available.

| Online Broker | Minimum Deposit | Deriv vs AvaTrade |

|---|---|---|

| Deriv | $5 Minimum Deposit | Deriv offers a range of platforms supporting different ways to trade markets, including margin and copy trading on MT5 and cTrader. Deriv vs AvaTrade |

| AvaTrade | $100 Minimum Deposit | AvaTrade provides MT4 and MT5, supporting a range of trading styles, including automated trading and social and copy trading as well as AvaOptions for Vanilla Options CFD trading and its AvaTradeGo mobile app. Deriv vs AvaTrade |

Leverage

Maximum leverage for AvaTrade (FCA or CySEC regulated) is . Maximum leverage for Deriv (MFSA regulated) is . Maximum leverage for Deriv (VFSC, BVIFSC, LFSA regulated) is 1000:1.

Online trading platforms

AvaTrade provides MT4, MT5, WebTrader, AvaOptions and AvaTradeGO. Deriv offers Derix X, MT5, cTrader for leveraged trading along with other platforms.

Why AvaTrade or Deriv ?

Traders who want to trade on MT4 and its successor MT5 may wish to consider AvaTrade. Those who want to trade on MT5 as part of a range of other platforms may wish to consider Deriv. Both provide margin trading of CFDs, though Deriv also offers other ways to trade markets. Deriv additionally has 24/7 trading of simulated markets, though each provides 24/7 trading of Cryptocurrency CFDs.

Comparison summary

- Both offer CFD trading based on real markets

- Deriv additionally provides CFDs based on simulated markets

- Each has 24/7 trading

- Both offer MT5

- AvaTrade additionally provides MT4

- Deriv additionally offers cTrader

- AvaTrade additionally provides its AvaTradeGO app and the AvaOptions platform

- AvaTrade has considerably more markets to trade on MT5 and its WebTrader